Week of July 24, 2023 in Review

- Is the Latest Fed Rate Hike the Last?

- Inflation Moving Lower Step by Step

- Housing Supply “Critical to Expand,” Says NAR

- Low Inventory Heightens Demand for New Homes

Home Prices Turning Higher

Is the Latest Fed Rate Hike the Last?

In a unanimous decision, the Fed hiked their benchmark Fed Funds Rate by 25 basis points at their meeting last Wednesday, bringing it to a range of 5.25% to 5.5%. The Fed Funds Rate is the interest rate for overnight borrowing for banks and it is not the same as mortgage rates. When the Fed hikes the Fed Funds Rate, they are trying to slow the economy and curb inflation.

This was the Fed’s eleventh hike since March of last year, though they chose not to hike at their meeting in June to give themselves more time to assess incoming data.

What’s the bottom line? In his press conference following the meeting, Fed Chair Jerome Powell was noncommittal regarding whether the Fed would hike at their next meeting on September 20. However, he sounded less hawkish (hawks are policy makers who favor higher interest rates to keep inflation in check), leaving the door open for a pause in September after previously signaling two hikes were left.

The Fed will be closely monitoring economic data before making their rate decision in September, including a few reports that were released after their meeting last week. The first reading of second quarter GDP showed that the economy grew at a stronger than estimated 2.4% annualized pace, while the latest Jobless Claims figures continue to reflect strength in the labor market. Plus, June’s Personal Consumption Expenditures (which is the Fed’s favored measure of inflation) provided more evidence that consumer inflation is cooling, as detailed below.

Inflation Moving Lower Step by Step

June’s Personal Consumption Expenditures (PCE) showed that headline inflation increased 0.2%, while the year-over-year reading fell all the way from 3.8% to 3%. Core PCE, which strips out volatile food and energy prices, also rose by 0.2% in June with the year-over-year reading down from 4.6% to 4.1%.

What’s the bottom line? While inflation is still elevated, it has made a big improvement from the 7% peak seen last year and is now less than half that amount at 3% on the headline reading. This welcome news not only signifies lower costs for some goods and services, but lower inflation also typically helps both Mortgage Bonds and mortgage rates improve over time.

Housing Supply “Critical to Expand,” Says NAR

Pending Home Sales rose 0.3% from May to June, beating estimates and marking the first increase since February. While sales were down almost 16% from a year earlier, this correlates to the lack of inventory, which is about 14% lower over the same period. Pending Home Sales is a critical report for taking the pulse of the housing market. The data is considered a forward-looking indicator of home sales because it measures signed contracts on existing homes, which represent around 90% of the market.

What’s the bottom line? Lawrence Yun, chief economist for the National Association of REALTORS® (NAR), explained, “The presence of multiple offers implies that housing demand is not being satisfied due to lack of supply. Homebuilders are ramping up production and hiring workers.” Quite simply, if there were more homes listed for sale, we’d have a much higher rate of signed contracts.

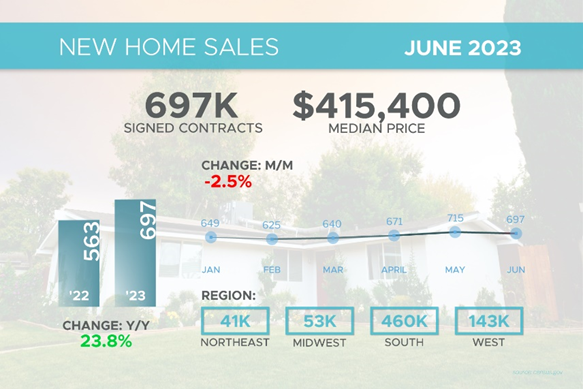

Low Inventory Heightens Demand for New Homes

New Home Sales, which measure signed contracts on new homes, fell 2.5% from May to June to a 697,000-unit annualized pace. However, this decline follows the large uptick in May and signed contracts for May and June are at the highest levels over the last year.

What’s the bottom line? The lack of existing homes for sale is heightening the demand for new homes, but the available supply of new construction remains below healthy levels. Of the 432,000 new homes for sale at the end of June, only 72,000 were completed, with the rest either not started or under construction. This ongoing dynamic of high demand relative to low supply will continue to be supportive of home prices, making homeownership a good investment and opportunity for building wealth through real estate.

On that note, the median sales price was $415,400, which was down from $432,700 a year ago. Despite what the media might suggest, this figure is not the same as appreciation but represents the mid-price and can be skewed by the mix of sales among lower-priced and higher-priced homes. Multiple appreciation reports show that home prices are rising again, as noted below.

Home Prices Turning Higher

The Case-Shiller Home Price Index, which is considered the “gold standard” for appreciation, showed home prices nationwide rose 0.7% from April to May after seasonal adjustment, marking the fourth consecutive month of accelerating gains. Prices were 0.5% lower when compared to May 2022, though this is partly because home prices rose much more sharply in the first half of 2022 than they have so far this year.

The Federal Housing Finance Agency (FHFA) also released their House Price Index, which revealed that home prices rose for the fifth straight month, up 0.7% from April to May. Prices also rose 2.8% from May 2022 to May 2023.

Note that FHFA’s report measures home price appreciation on single-family homes with conforming loan amounts, which means it most likely represents lower-priced homes. FHFA also does not include cash buyers or jumbo loans, and these factors account for some of the differences in the two reports.

What’s the bottom line? “The rally in U.S. home prices continued in May 2023,” explained S&P DJI Managing Director Craig J. Lazzara, who added that “the ongoing recovery in home prices is broadly based.” The latest numbers from Case-Shiller and FHFA follow the strong home price growth that has also been reported by CoreLogic, Zillow and Black Knight in their respective indexes. The data combined shows that home prices are clearly moving upward.

Family Hack of the Week

These Tropical Breakfast Bars courtesy of BBC Good Foods are a healthy and delicious on-the-go breakfast, perfect for camping, road trips and more summer fun.

Preheat oven to 350 degrees Fahrenheit. Lightly oil an 8-inch square baking tin and line with parchment paper.

Mash 2 large ripe bananas in a bowl and then stir in 3 tablespoons vegetable oil, 1 large egg (beaten) and 1/2 cup light brown sugar. Fold in 2 cups of your favorite muesli or granola, 1 cup tropical dried fruit mix, and a pinch of salt.

Spoon the mixture into the prepared tin and sprinkle a handful of the dried fruit on top. Bake for 35 to 40 minutes. Once the bars have cooled, cut into 10 slices. Store in an airtight container for up to four days.

What to Look for This Week

Look for important updates on the labor sector starting Tuesday with news on job openings via the JOLTS report for June. Wednesday brings ADP’s Employment Report for July, which measures private payrolls while the latest Jobless Claims will be reported on Thursday. The biggest headline comes Friday with July’s Jobs Report from the Bureau of Labor Statistics, which includes Non-farm Payrolls and the Unemployment Rate.

Technical Picture

Mortgage Bonds tested overhead resistance at 99.234 last Friday. If Bonds can break convincingly above this level, there is room to the upside before the next ceiling at their 25-day Moving Average. The 10-year is back under 4% and has room to move lower until reaching support at 3.90%.