Week of July 31, 2023 in Review

Conflicting data begs the question – what’s really going on in the job market? Plus, low housing supply is having a clear impact on home prices. Read on for these stories and more:

- Where Are Job Gains Really Coming From?

- Leisure and Hospitality Continues to Boost Private Payrolls

- Initial Jobless Claims Remain Tame

- Impact of Work from Anywhere on Job Openings

- Tight Supply Adding Pricing Pressure to Housing

The Bureau of Labor Statistics (BLS) reported that there were 187,000 jobs created in July, which was weaker than estimates. Job growth in May and June was also revised lower, subtracting 49,000 jobs in those months combined. The unemployment rate fell from 3.6% to 3.5%.

What’s the bottom line? The headline job number comes from the report’s Business Survey, which is based predominantly on modeling and estimations. In fact, one of the biggest reasons we saw job gains last month was the birth/death model, where the BLS estimates new business creation relative to closed businesses and how many jobs this created. In July, this modeling added 280,000 jobs but it’s hard to believe that many businesses were started last month in the current economic climate, especially given the cost of capital.

Job gains are clearly slowing, as job growth in June (185,000) and July (187,000) were the two lowest levels reported since December 2020. Plus, a deeper look at the data shows that part-time workers increased by 972,000, while multiple job holders rose by 118,000, meaning some people are having to pick up second jobs to get by. Full-time workers also fell by 585,000.

Average weekly hours also declined slightly, which is important because one of the ways businesses cut costs is to cut the number of hours worked. This caused average weekly earnings, which is a good reflection of take-home pay, to only increase 0.1% from June.

Overall, this data suggests underlying weakness in the job market and economy in general.

Leisure and Hospitality Continues to Boost Private Payrolls

The ADP Employment Report showed that private payrolls were much stronger than expected in July, with 324,000 jobs created. Annual pay for job stayers increased 6.2% and job changers saw an average increase of 10.2%. While these pay gains are still high, they have been moderating over the last year.

Leisure and hospitality once again led the way with 201,000 job gains (more than quadruple any other sector), while manufacturing was a weak spot, shedding jobs for the fifth straight month. This correlated with July’s ISM Index, as their survey of purchasing and supply executives nationwide showed a “slowdown in hiring, with attrition, freezes and layoffs actively in place.”

What’s the bottom line? The high level of leisure and hospitality job gains may not continue to bolster the overall private payroll total for much longer, as we have now eclipsed the number of employees in this sector pre-Covid. Plus, the BLS Jobs Report only showed 17,000 leisure and hospitality job gains in July, while the latest Job Openings and Labor Turnover Survey (JOLTS) showed that leisure and hospitality job openings fell to their lowest level since March 2021. The data combined suggests softer job growth in this area to come.

We have seen large discrepancies in the BLS and ADP Employment Reports in recent months, which may be due to issues with seasonal adjustments. This will be something to watch closely heading into the fall.

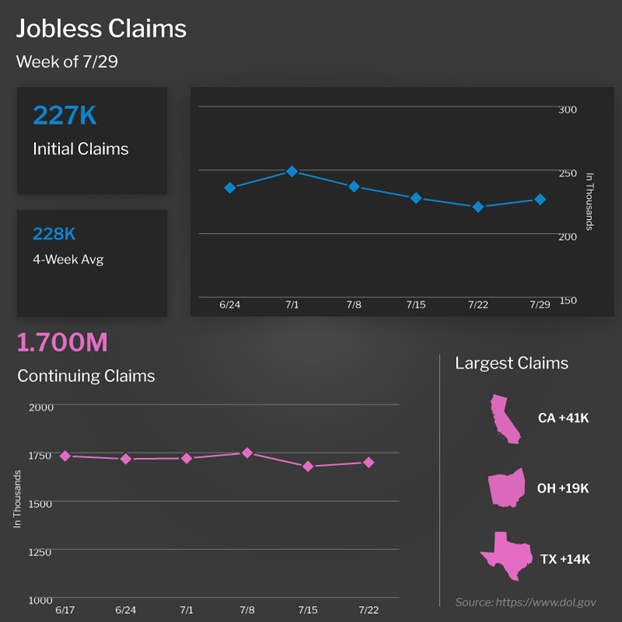

Initial Jobless Claims Remain Tame

Initial Jobless Claims rose by 6,000 in the latest week, as 227,000 people filed for unemployment benefits for the first time. While this number can be volatile from week to week, first-time filers have remained under 230,000 for the last three weeks after topping 260,000 in the first three weeks of June. This tamer level of Initial Claims shows that employers are still clearly trying to retain their workers.

Meanwhile, Continuing Claims rose by 21,000, with 1.7 million people still receiving benefits after filing their initial claim. While this latter metric is well above the low of 1.289 million seen last September, it has declined from the high of 1.861 million reported in early April, reflecting a mix of people finding new jobs and benefits expiring.

Impact of Work from Anywhere on Job Openings

The latest Job Openings and Labor Turnover Survey (JOLTS) showed that job openings declined from 9.62 million in May to 9.58 million in June, as they continue to trend lower since peaking in March 2022. Note that job openings are still elevated compared to pre-Covid levels, but the reported total is likely overstated.

As work from anywhere became more common during Covid, the frequency of seeing the same job listing posted in multiple states has increased. This has added a new dynamic to the JOLTS data and is certainly a factor in the larger number of openings that we are now seeing when compared to before the pandemic.

Tight Supply Adding Pricing Pressure to Housing

CoreLogic’s Home Price Index showed that home prices nationwide rose for the fifth straight month, up 0.5% from May to June. Prices were also 1.6% higher when compared to June of last year. CoreLogic forecasts that home prices will rise 0.6% in July and 4.3% in the year going forward.

Zillow also reported that home values have increased 4.8% this year. They’re forecasting that home values will rise 6.3% from June 2023 to June 2024, and predicting that 48 of the nation’s 200 largest markets will see increases of 7% or more.

What’s the bottom line? The latest rise in home prices reported by CoreLogic and Zillow echoes the strong growth seen in other appreciation indexes, including those released by Case-Shiller, Black Knight, and the Federal Housing Finance Agency. Tight supply is a key factor impacting prices, with CoreLogic’s Chief Economist, Selma Hepp, explaining that “the continued imbalance between buyers and sellers continues to pressure home prices.” This is why homeownership remains a good investment and opportunity for building wealth through real estate.

Family Hack of the Week

August 4 was National Chocolate Chip Cookie Day. Try these Double Chocolate Chip Cookies from Allrecipes for an extra fudgy and delicious chocolate lovers’ treat.

Preheat oven to 350 degrees Fahrenheit. In a large bowl, beat 1 1/2 cups granulated sugar, 1 cup butter (softened), 2 eggs, and 2 teaspoons vanilla until light and fluffy. In a separate large bowl, combine 2 cups all-purpose flour, 2/3 cup cocoa powder, 3/4 teaspoon baking soda, and 1/4 teaspoon salt. Stir in butter mixture until well blended. Mix in 2 cups chocolate chips and 1/2 cup chopped walnuts.

Drop spoonfuls of dough onto ungreased cookie sheets 2 inches apart. Bake until cookies are set, approximately 8 to 10 minutes. Cool slightly, then transfer to a wire rack to cool completely.

What to Look for This Week

Crucial inflation reports are ahead, starting with June’s Consumer Price Index on Thursday. Look for the Producer Price Index on Friday, which will give us news on wholesale inflation.

Also of note, Tuesday brings the NFIB’s report on confidence among small business owners for July. The latest Jobless Claims will be reported as usual on Thursday. Investors will also be closely watching Wednesday’s 10-year Note and Thursday’s 30-year Bond auctions for the level of demand.

Technical Picture

Mortgage Bonds rebounded last Friday after testing support at 98.089 and then breaking back above resistance at 98.716. If they can maintain this level, the next ceiling is the 25-day Moving Average. The 10-year broke beneath an important floor of support at 4.09%. If yields can stay under this level, there is a path down towards 4%.