Week of July 17, 2023 in Review

- Existing Home Sales Constrained by Tight Supply

- Home Builder Confidence Edged Higher This Month

- Can’t Get Enough New Home Inventory

- Unemployment Claims Remain Volatile

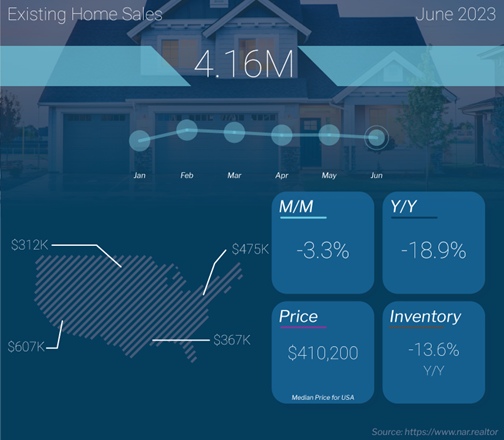

Existing Home Sales Constrained by Tight Supply

Existing Home Sales fell 3.3% from May to June to a 4.16-million-unit annualized pace, per the National Association of REALTORS® (NAR). Sales were also 18.9% lower than they were in June of last year. This report measures closings on existing homes, which represent around 90% of the market, making it a critical gauge for taking the pulse of the housing sector.

What’s the bottom line? Tight supply played a key role in the pace of sales, per NAR’s Chief Economist Lawrence Yun, who noted that, “The first half of the year was a downer for sure with sales lower by 23%. Fewer Americans were on the move despite the usual life-changing circumstances. The pent-up demand will surely be realized soon, especially if mortgage rates and inventory move favorably.”

In fact, total existing housing inventory at the end of June equaled 1.08 million homes, well below normal with just 3.1 months’ supply available at the current sales pace. Redfin’s Housing Report for June further reiterated the tight supply we’re seeing, with active and new listings down 15% and 31% year-over-year, respectively. Yun added that, “There are simply not enough homes for sale. The market can easily absorb a doubling of inventory.”

Despite these supply constraints, demand among buyers remains strong as evidenced by how quickly correctly priced homes are selling. Homes stayed on the market on average for 18 days last month, while 76% of homes sold in June were on the market for less than a month. By comparison, this is up from 65% back in March.

Very tight inventory and strong demand puts upward pressure on home prices. Zillow, Black Knight and FHFA are already reporting record high home values in their indexes, showing why now remains a great opportunity to build wealth through homeownership.

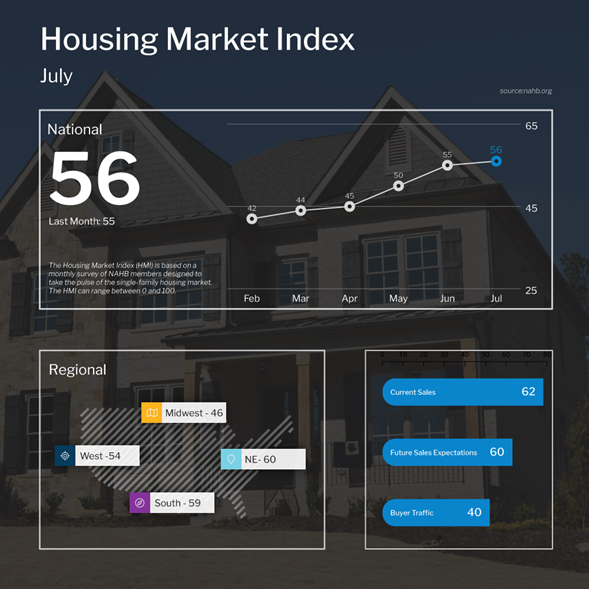

Home Builder Confidence Edged Higher This Month

The National Association of Home Builders (NAHB) Housing Market Index, which measures builder confidence, rose one point to 56 in July. This latest reading marks the seventh straight increase, with builder sentiment now at the highest level since June 2022 and firmly in expansion territory over the breakeven level of 50.

What’s the bottom line? Low existing home inventory continues to boost optimism among home builders, as it is keeping the demand for new homes “solid” per the NAHB. Among the components of the index, current and future sales expectations are well in expansion territory at 62 and 60, respectively. Buyer traffic moved three points higher to 40, which is a big recovery from the low of 20 seen late last year as this gauge moves closer to the 50 breakeven level.

Can’t Get Enough New Home Inventory

Despite rising confidence among builders, home construction slowed down in June as Housing Starts, which measure the start of construction on homes, fell 8% from May. However, this number can be volatile from month to month and the pullback in June followed a big uptick in May’s construction activity.

Building Permits, which are indicative of future supply, also declined 3.7% from May to June. On a positive note, permits for single-family homes rose 2.2% from May to the highest level since June of last year.

What’s the bottom line? The housing sector remains undersupplied and not enough inventory is heading to the market. Housing Completions fell by 3.3% last month, with single-family completions down by 2.8%. When we look at new supply that will be coming to market, which is currently around 1.4 million homes annualized, and subtract roughly 100,000 homes that need to be replaced every year due to aging, we’re well below demand as measured by household formations that are trending at 1.5 million.

As noted above, this ongoing disparity between supply and demand is a key reason why home values continue to rise and why now provides great opportunities to take advantage of appreciation gains.

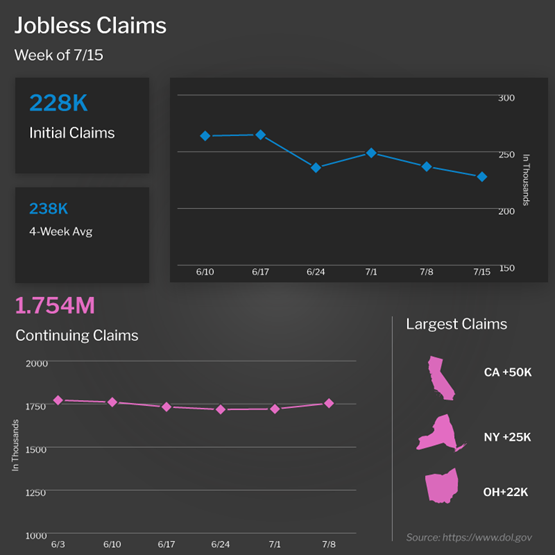

Unemployment Claims Remain Volatile

Initial Jobless Claims fell by 9,000 in the latest week, as 228,000 people filed for unemployment benefits for the first time. Continuing Claims rose by 33,000, with 1.754 million people still receiving benefits after filing their initial claim. While this latter metric is well above the low of 1.289 million seen last September, it has declined from the high of 1.861 million reported in early April, reflecting a mix of people finding new jobs and benefits expiring.

What’s the bottom line? Initial Jobless Claims are volatile from week to week, but economists had expected first-time filings to rise since the previous report encompassed a holiday week. Plus, Initial Claims have declined to tamer numbers over the last month after topping 260,000 for the first three weeks of June. Employers are still clearly trying to retain workers.

Yet, there has also been a clear slowdown in the pace of hirings in the private sector. Last year, private sector job gains averaged 376,000 a month but we’ve seen this number decline to 215,000 a month over the last six months and 196,000 over the last three months.

Family Hack of the Week

This rich and decadent Hot Fudge Sauce courtesy of the New York Times is perfect for National Hot Fudge Sundae Day on July 25 – or any day you fancy it.

In a medium saucepan, combine 2 cups heavy cream, 4 tablespoons unsalted butter, 1/2 cup light brown sugar, 3/4 cup granulated sugar and 1/4 teaspoon fine sea salt. Bring to a simmer over medium-low heat. After a minute, add 2 ounces chopped bittersweet chocolate and whisk to dissolve. Remove from heat, add 1-1/4 cups Dutch-process cocoa, and whisk until no lumps remain.

Return pan to low heat and simmer fudge sauce until glossy, whisking constantly, approximately 20 seconds. Remove from heat and stir in 1/2 teaspoon pure vanilla extract.

Serve warm over your favorite ice cream and sprinkle with nuts or other toppings you love.

What to Look for This Week

This week is full of potentially market-moving news. The Fed’s two-day meeting begins Tuesday, with their Monetary Policy Statement and press conference coming on Wednesday. June’s reading of the Fed’s favored measure of inflation, Personal Consumption Expenditures, will also be reported on Friday.

In housing news, look for an update on home price appreciation for May when the Case-Shiller Home Price Index and the Federal Housing Finance Agency House Price Index are reported on Tuesday. June’s New and Pending Home Sales follow on Wednesday and Thursday, respectively.

Also on Thursday, the latest Jobless Claims will be reported along with June’s Durable Goods Orders and the first look at GDP for the second quarter.

Technical Picture

Mortgage Bonds tested the ceiling at their 25-day Moving Average on Friday but were rejected lower. The 10-year also tested support at its 25-day Moving Average and was able to move higher. If yields continue to move higher, the next ceiling is at the 3.9% Fibonacci level.