Week of June 5, 2023 in Review

- More Signs of Home Price Strength

- Has the Job Market Reached a Turning Point?

- Why Recession Talk from Europe Matters Here

More Signs of Home Price Strength

CoreLogic’s Home Price Index showed that home prices nationwide rose by 1.2% from March to April and they were 2% higher when compared to April of last year. April marks the third consecutive month of nationwide price increases per CoreLogic’s Index, after prices also rose 1.6% in March and 0.8% in February. CoreLogic forecasts that home prices will rise 0.9% in May and 4.6% in the year going forward, up from the 3.7% annual increase they forecasted just two months ago.

What’s the bottom line? Home prices have reached an inflection point with gains occurring across much of the country. CoreLogic’s Chief Economist Selma Hepp explained, “While mortgage rate volatility continues to cause buyer hesitation, the lack of for-sale homes is putting firm pressure on prices this spring, leading to above-average seasonal monthly gains and a rebound in home prices in most markets.”

Meanwhile, Zillow’s Housing Market Report showed that home prices climbed 1.4% from April to May. Black Knight also reported that home prices rose 0.5% in April, with Vice President of Enterprise Research Andy Walden noting that, “April marked the fourth consecutive month of home price gains, which are now almost universally rising across the country again on a seasonally adjusted basis.”

Has the Job Market Reached a Turning Point?

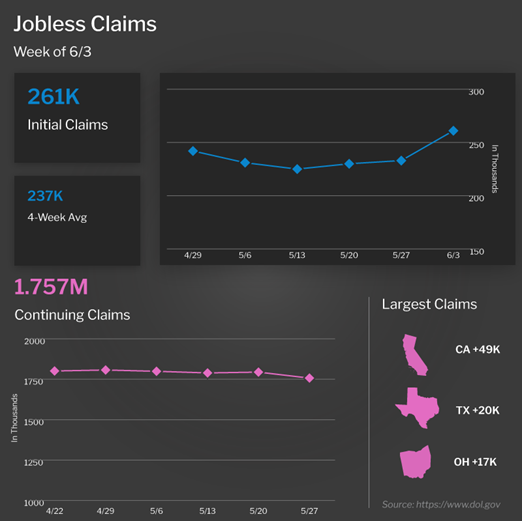

Initial Jobless Claims surged by 28,000 in the latest week, with 261,000 people filing for unemployment benefits for the first time. This is the highest level in 20 months and this number has been trending higher, with Initial Jobless Claims topping 200,000 every week since the start of February.

Meanwhile, the number of people still receiving benefits after their initial claim is filed remains elevated with 1.757 million Continuing Claims reported. This is well above the low of 1.289 million seen last September and this upward trend shows the difficulties many people are having as they search for new employment.

Why Recession Talk from Europe Matters Here

Statistics agency Eurostat reported that the euro zone economy entered a recession in the first quarter of this year. This news comes after negative revisions to Germany’s and Ireland’s first quarter Gross Domestic Product (GDP), which pushed the 20-member bloc to a negative 0.1% first quarter GDP reading after a previous reading of 0%. Economists also noted they aren’t optimistic about growth in Europe the remainder of the year.

What’s the bottom line? The globe is interconnected, and economies of different countries rely on each other for trade. As a result, recessions tend to be globally synchronized because loss of demand in one country tends to pull activity in other areas down. While there is usually an average of 50% of global economies in a recession at the same time, certain circumstances like the COVID pandemic can lead to a larger level of synchronicity. This ongoing situation remains important to monitor in the months ahead.

Family Hack of the Week

This Chocolate Fudge recipe from our friends at Allrecipes is equal parts simple and delicious, and the perfect way to mark National Fudge Day on June 16.

In a large microwave-safe bowl, combine 3 cups semisweet chocolate chips, one 14-ounce can sweetened condensed milk, and 1/4 cup unsalted butter (cut into pieces). Microwave on medium heat until chips are melted, about 3 to 5 minutes, stirring a few times.

Grease an 8-inch square glass baking dish. Remove chocolate mixture from the microwave and stir in your favorite add-ins, such as 1 cup chopped walnuts or mini marshmallows.

Pour mixture into prepared baking dish and refrigerate until set, about 2 hours. Cut into 16 squares and enjoy!

What to Look for This Week

Inflation will be one of the top stories, with May’s Consumer Price Index releasing on Tuesday. Look for the Producer Price Index on Wednesday, which will give us news on wholesale inflation.

The Fed will also make headlines as their two-day meeting begins Tuesday, with their Monetary Policy Statement and press conference coming on Wednesday.

Also of note, Tuesday brings a read on confidence among small businesses last month from the NFIB. On Thursday, look for May’s Retail Sales, June’s manufacturing data for the New York and Philadelphia regions, and the latest Jobless Claims.

Technical Picture

Mortgage Bonds were able to break above the ceiling of resistance at the 99.845 Fibonacci level on Friday, with the next ceiling at the 25-day Moving Average. Bonds have traded sideways over the past two weeks, so Tuesday’s CPI data could be market moving. The 10-year tested the ceiling at 3.773% on Friday and was rejected to the downside. The next level of support is at the 3.644% Fibonacci level.