Week of May 29, 2023 in Review

- Conflicting Job Numbers

- Leisure and Hospitality Jobs Boost Private Sector Employment

- Unemployment Claims Remain Elevated

- Home Prices Continue to Rebound

Conflicting Job Numbers

The Bureau of Labor Statistics (BLS) reported that there were 339,000 jobs created in May, which was much larger than estimates. Job growth in March and April was also revised higher, adding 93,000 additional jobs in those months combined. The unemployment rate rose from 3.4% to 3.7%.

What’s the bottom line? There are two reports within the Jobs Report and there is a fundamental difference between them. The Business Survey is where the headline job number comes from, and it’s based predominately on modeling and estimations. The Household Survey, where the Unemployment Rate comes from, is derived by calling households to see if they are employed, so it’s a bit more real-time.

The Household Survey has its own job creation component, and it showed that there were 310,000 job losses, which is a stark contrast to the headline job growth number.

In addition, one of the biggest reasons we saw job gains in the Business Survey was the birth/death model, where the BLS estimates hiring from new business creation relative to closed businesses. The problem with this modeling is it overestimates during the inflection point of a downturn (like we’re in right now) and underestimates at the inflection of an upturn after a recession.

In May, this modeling added 231,000 jobs but it’s hard to believe that many businesses were created last month in the current economic climate where there is less lending from banks.

Leisure and Hospitality Jobs Boost Private Sector Employment

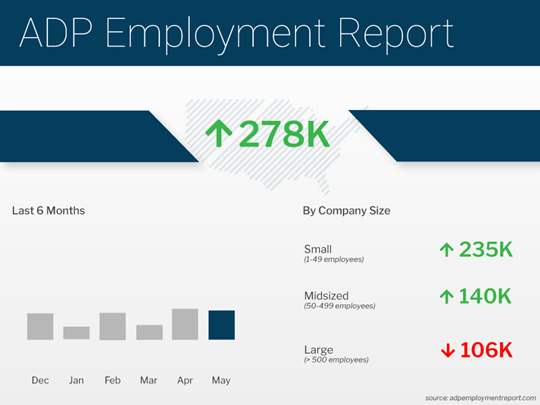

Private payrolls were much stronger than expected last month, as the ADP Employment Report showed that there were 278,000 jobs created in May. Annual pay for job stayers increased 6.5% and job changers saw an average increase of 12.1%. While these figures are still high, they reflect a year-long slowdown and lower wage-pressured inflation.

What’s the bottom line? ADP noted that “gains in private employment were fragmented last month.” Leisure and hospitality once again led the way with 208,000 job gains, which was more than double the growth reported in any other industry sector. However, these job gains may not continue to bolster the overall private payroll total for much longer.

In April 2019, there were 16.2 million leisure and hospitality employees and there are now 16.5 million after last month’s gains, meaning we have eclipsed where we were pre-Covid.

Unemployment Claims Remain Elevated

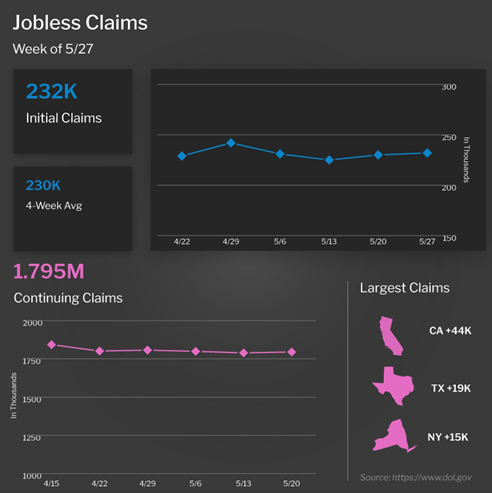

Initial Jobless Claims rose 2,000 in the latest week, with 232,000 people filing for unemployment benefits for the first time. Again, this reflects 232,000 new filers and we have seen Initial Jobless Claims top 200,000 every week since the start of February.

Meanwhile, the number of people still receiving benefits after their initial claim is filed remains elevated with 1.795 million Continuing Claims reported. This is well above the low of 1.289 million seen last September and this upward trend shows the difficulties many people are having as they search for new employment.

Home Prices Continue to Rebound

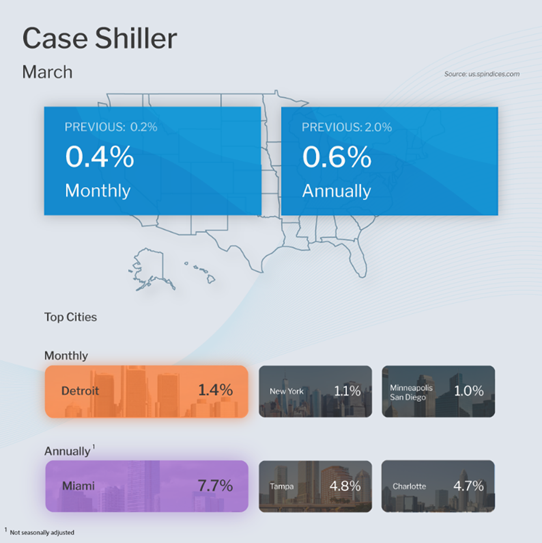

The Case-Shiller Home Price Index, which is considered the “gold standard” for appreciation, showed home prices nationwide rose 0.4% from February to March after seasonal adjustment. Home prices were also 0.7% higher when compared to March 2022, though this annual reading is a decline from the 2.1% gain reported in February.

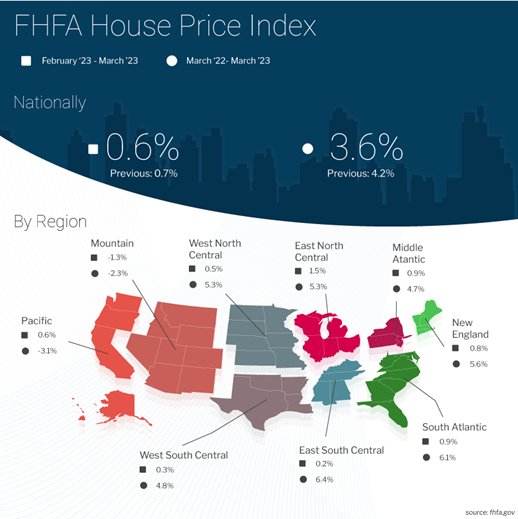

The Federal Housing Finance Agency (FHFA) also released their House Price Index, which revealed that home prices rose 0.6% from February to March. This follows the 0.1% monthly gain reported in January and the 0.7% gain in February. Prices rose 3.6% from March 2022 to March 2023, though this was a slight decline from the 4.2% annual increase reported in February.

These figures differ in part because FHFA’s report measures home price appreciation on single-family homes with conforming loan amounts, which means it most likely represents lower-priced homes. FHFA also does not include cash buyers or jumbo loans.

Home Hack of the Week

The official start of summer is just a few weeks away. These quick and easy seasonal tips will ensure your home is ready for the warmer weather.

Your air conditioner is the last thing you want to fail when you really need it. If you haven’t scheduled a service call for your unit yet this year, now is the perfect time to do so.

Clean your ceiling fans with a damp rag to make sure they don’t spread any allergens when you’re ready to use them. Also, make sure they’re set to spin counterclockwise to provide cool air during the summer months.

Check playgrounds and other outdoor sports equipment for any cracks or warping that may have occurred during the winter months. Double check fences as well for any rotten or sagging areas. If you have an electric fence for pets, check the batteries.

Keep your garage safe for kids and pets by storing gasoline for your lawnmower or grill, paint and any other chemicals out of their reach.

Check and replace any outdoor light bulbs, especially around your porch and deck if your family enjoys spending time outside in the warm evenings. As an added bonus, consider adding string lights for both extra light and ambiance.

What to Look for This Week

The economic calendar is fairly quiet, but we will see more housing appreciation data when CoreLogic’s Home Price Index for April is released on Tuesday. The latest Jobless Claims data will also be reported on Thursday.

Technical Picture

Mortgage Bonds moved lower on Friday following the BLS Jobs Report, and they ended last week battling support at the 99.845 Fibonacci level. The 10-year was able to break above overhead resistance at the 3.644% Fibonacci level. The next ceiling is all the way up at 3.786%.