Week of May 8, 2023 in Review

- Annual consumer and producer inflation continue lower

- Jobless Claims continue higher

- Small Business Optimism Hits 10-Year Low

CPI Continues Downward Trend

Consumer inflation rose 0.4% in April per the Consumer Price Index (CPI), with this headline reading coming in-line with estimates. On an annual basis, CPI fell from 5% in March to 4.9% last month. Core CPI, which strips out volatile food and energy prices, increased 0.4% while the annual reading fell from 5.6% to 5.5%.

In addition, the shelter index increased 8.1% over the last year, accounting for 43.2% of the total increase in all items less food and energy per the Bureau of Labor Statistics. However, shelter costs have been declining in more real-time data. For example, Apartment List’s latest Rent Report showed that year-over-year rent growth decelerated to 1.7% in April, the lowest level since March 2021. Once these moderating shelter costs are reflected in the CPI data, they will add additional downside pressure to inflation.

What’s the bottom line? While annual inflation remains elevated at 4.9%, it has declined sharply from the 9.1% peak seen last June. Lower inflation helps both Mortgage Bonds and mortgage rates improve, so these signs of easing inflation are welcome.

PPI Continues Downward Trend

The Producer Price Index (PPI), which measures inflation on the wholesale level, rose 0.2% in April, coming in below expectations of 0.3%. On an annual basis, PPI fell from 2.7% to 2.3%. Core PPI, which strips out volatile food and energy prices, also rose 0.2% with the year-over-year reading dropping from 3.4% to 3.2%.

What’s the bottom line? Annual wholesale inflation readings have made significant improvement as they continue to move lower in the right direction. At its peak last March, PPI was at 11.7% year-over-year and it is now at 2.7%, which is a decline of 9%!

Jobless Claims Continue Lower

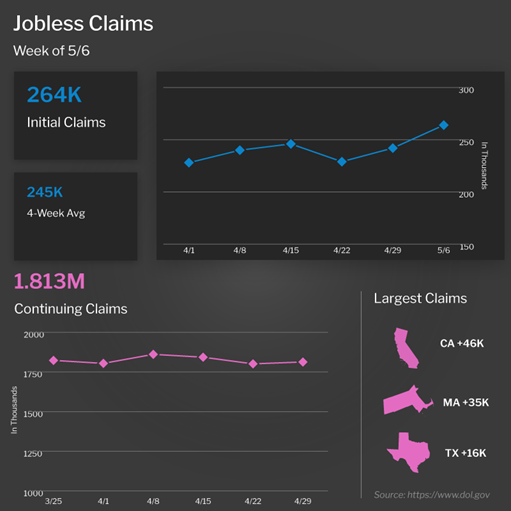

Initial Jobless Claims rose by 22,000 in the latest week, as 264,000 people filed for unemployment benefits for the first time. This is the highest Initial Jobless Claims print since October 2021. Since October 2022, Initial Jobless Claims have risen by 84,000. While not in a straight line, the trend is higher overall.

Continuing Claims rose by 12,000 to 1,813,000. This number measures people who continue to receive unemployment benefits after their initial claim is filed. Continuing Claims have been rising substantially and remain elevated.

What’s the bottom line? Jobless Claims can be volatile from week to week, but they continue to trend higher. The labor market has been extremely tight for quite some time. However, it’s been showing signs of weakening as of late.

Small Business Optimism Hits 10-Year Low

The National Federation of Independent Business (NFIB) Small Business Optimism Index weakened to 89 in April. This is the lowest level in more than ten years and marked the sixteenth straight month the index has come in below the 49-year average of 98. Among the key takeaways, 24% of small business owners reported that labor quality was their top problem, with inflation a close second at 23%.

What’s the bottom line? Overall, small business owners are “cynical about future economic conditions,” per NFIB’s chief economist Bill Dunkelberg. The report showed that compensation plans and higher selling prices moderated while the earnings outlook, capital spending plans, and those expecting higher sales all declined. In addition, those expecting a better economy fell to nearly the lowest level on record. This data in totality points to a slowing economy and a recession.

Family Hack of the Week

This week marks National Chocolate Chip Day on May 15. Celebrate the occasion with this easy and delicious Chocolate Chip Blondie recipe courtesy of Taste of Home.

Preheat oven to 350 degrees Fahrenheit. Grease a 13×9-inch baking pan.

In a large bowl, combine 1 1/2 cups packed brown sugar, 1/2 cup butter (melted), 2 large eggs (lightly beaten), and 1 teaspoon pure vanilla extract until just blended. In a separate bowl, combine 1 1/2 cups all-purpose flour, 1/2 teaspoon baking powder, and 1/2 teaspoon salt.

Add flour mixture to brown sugar mixture and stir to combine. Stir in 1 cup of semisweet or bittersweet chocolate chips.

Spread batter into prepared baking dish and bake until a toothpick inserted comes out clean, approximately 18 to 20 minutes. Cool on a wire rack. Cut into bars and enjoy with a cup of coffee or tea.

What to Look for This Week

Crucial housing reports are ahead, starting Tuesday with builder confidence for this month from the National Association of Home Builders. April’s Housing Starts and Building Permits will be reported on Wednesday while Existing Home Sales follows on Thursday.

In other news, May’s manufacturing data for the New York and Philadelphia regions will be released on Monday and Thursday, respectively. Look for April’s Retail Sales on Tuesday while the latest Jobless Claims will be reported as usual on Thursday.

Technical Picture

Mortgage Bonds ended the week by breaking beneath the quad level of support and are battling their 50-day moving average.

The 10-year Treasury has broken above its ceiling at 3.43% and is battling its 25-day moving average. If this level fails to keep a lid on yields, we may see a retesting of the 50-day moving average.