Week of November 6, 2023 in Review

More reports show that home prices are setting records, while continuing unemployment claims hit a seventh-month high. Plus, what you need to know about some key recession indicators. Here are last week’s headlines:

Home Prices Continue to Hit New Highs

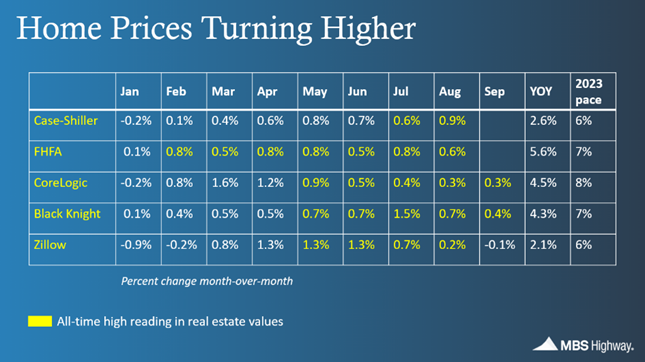

CoreLogic’s Home Price Index showed that home prices nationwide rose 0.3% from August to September, hitting a new all-time high for the fifth straight month. CoreLogic forecasts that home prices will rise 0.1% in October and 2.6% in the year going forward, though their forecasts tend to be on the conservative side historically. In fact, CoreLogic’s index is on pace for 8% appreciation in 2023, based on the monthly readings we’ve seen so far this year.

Black Knight also reported that national home values rose 0.4% in September, with their index also showing new all-time highs in home values for the fifth month in a row. Home prices are now almost 3% above the 2022 peak in Black Knight’s index, which is on pace for 7% appreciation this year based on the monthly gains we’ve seen to date.

What’s the bottom line? The latest rise in home prices reported by CoreLogic and Black Knight echoes the strong growth seen by other major indices like Case-Shiller, Zillow and the Federal Housing Finance Agency. These reports continue to demonstrate why homeownership remains a good opportunity for building wealth through real estate.

Continuing Jobless Claims Increase for Seventh Straight Week

Initial Jobless Claims declined by 3,000 in the latest week, with 217,000 people filing for unemployment benefits for the first time. The real story remains Continuing Claims, which increased by 22,000, showing that 1.834 million people are still receiving benefits after filing their initial claim. The last time Continuing Claims were this high was back in April.

What’s the bottom line? Initial Jobless Claims remain relatively low on a historical basis, suggesting that employers are trying to hold on to workers. However, Continuing Claims have risen for seven straight weeks, up by 176,000 in this timeframe, suggesting that it’s becoming harder for people to find employment once they are let go.

This sentiment was echoed by ZipRecruiter last week during their third quarter earnings call. Cofounder and CEO Ian Siegel explained that the Fed’s rapid pace of rate hikes has increased borrowing costs for businesses, leading to “a much more cautious approach to hiring.”

He added that there are lower job openings and less hiring, and as a result, “job seekers are taking longer to find work and those currently employed are changing jobs less frequently.” In fact, he noted that the quit rate has returned to pre-pandemic levels.

What Important Recession Indicators Are Saying

The latest Jobs Report from the Bureau of Labor Statistics showed that the unemployment rate reached 3.9% in October, compared to the low of 3.4% reached in April while the economy was expanding. This level of increase has been a reliable leading indicator of a recession historically. From 1970 onwards, when the unemployment rate has risen by 0.5% or more from the expansion low, a recession was either already occurring or occurred within two months.

Another recession indicator called the Sahm Rule (named after former Fed economist Claudia Sahm) flashes when the three-month moving average of the unemployment rate rises by 0.5% or more relative to its low during the previous 12 months. If the unemployment rate in November rises to 4.2% (this data will be reported on December 8), this indicator would trigger.

A third labor market recession indicator occurs when the number of people unemployed for 15 weeks or longer (as measured by the Bureau of Labor Statistics Jobs Report) rises by 19% or more on a year-over-year basis. We just crossed that threshold in the last report that was released on November 3.

What’s the bottom line? While a recession is not a great thing for the economy, one positive aspect is that periods of recession are always coupled with lower interest rates.

Family Hack of the Week

This Banana Nut Bread from the Food Network is easy to make and perfect to snack on any time of day.

Preheat oven to 350 degrees Fahrenheit. Grease a 9x5x3-inch loaf pan. In a medium bowl, sift 1 1/4 cups all-purpose flour, 1 teaspoon baking soda, and 1/2 teaspoon salt and set aside. Whisk 2 large eggs and 1/2 teaspoon vanilla together in a liquid measuring cup with a spout and set aside.

Using a stand or handheld mixer, cream together 1/2 cup unsalted butter (room temperature) and 1 cup sugar until light and fluffy. Gradually pour the egg mixture into the butter mixture and mix until incorporated. Mash 3 ripe bananas with a fork and add to batter.

Remove bowl from stand mixer and stir in flour mixture until just incorporated. Stir in 1/2 cup toasted walnut pieces. Add batter to the prepared tin and bake for 55 minutes or until a toothpick inserted in the center comes out clean. Allow bread to cool in the pan on a wire rack for 5 minutes before turning the bread out of the pan to cool completely.

What to Look for This Week

Crucial inflation reports are ahead, with October’s Consumer Price Index releasing on Tuesday and Producer Price Index (which measures wholesale inflation) on Wednesday.

Housing data will also make headlines, starting Thursday with an update on home builder sentiment for this month from the National Association of Home Builders. October’s Housing Starts and Building Permits will be reported on Friday.

Also, look for November’s manufacturing data for the New York and Philadelphia regions on Wednesday and Thursday, respectively. October’s Retail Sales will be released on Wednesday and the latest Jobless Claims on Thursday.

Technical Picture

Mortgage Bonds ended last week beneath support at their 50-day Moving Average. If they remain below this level, the next floor is at their 25-day Moving Average. The 10-year ended the week trading in a range between support at their 50-day Moving Average and a ceiling at their 25-day Moving Average.