Week of October 16, 2023 in Review

Tight housing inventory and elevated mortgage rates remain key headwinds for homebuyers and home builders. Plus, there was more Fed chatter about rates and the labor sector “WARNing” you need to know about. Here are the headlines:

- “Pressing Need” for More Housing Inventory

- Housing Starts Rise but Is a Pullback Ahead?

- Home Builder Confidence “Hammered” by Elevated Rates

- More Signs of a Fed Rate Hike Pause?

- “WARNing” Ahead for Jobless Claims?

“Pressing Need” for More Housing Inventory

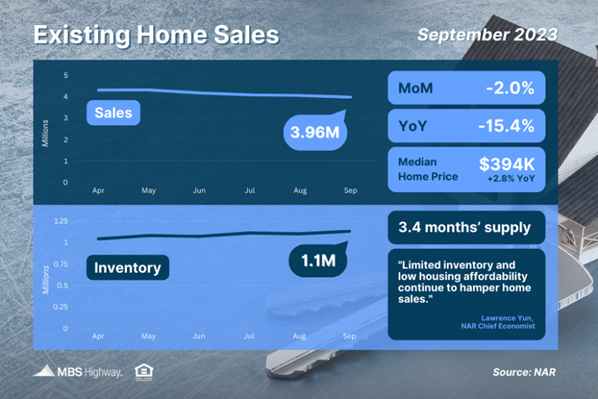

Existing Home Sales fell 2% from August to September to a 3.96-million-unit annualized pace, reaching a 13-year low, per the National Association of REALTORS® (NAR). Sales were also 15.4% lower than they were in September of last year. This report measures closings on existing homes and is a critical gauge for taking the pulse of the housing sector.

What’s the bottom line? Tight inventory and elevated mortgage rates remain key constraints on home sales. There were 1.13 million homes available for sale at the end of September, down from 1.23 million a year earlier and nearly half the levels seen in 2019. Plus, inventory is even tighter than that figure implies, as many homes counted in existing inventory are under contract and not truly available for purchase. In fact, there were only 702,000 “active listings” at the end of last month.

NAR’s Chief Economist, Lawrence Yun, noted that “there was a “pressing need for more housing supply.” Yet despite ongoing inventory constraints, homes continue to sell quickly (averaging just 21 days on the market). And 69% of homes sold in less than a month, showing that demand is strong for what’s out there.

Housing Starts Rise but Is a Pullback Ahead?

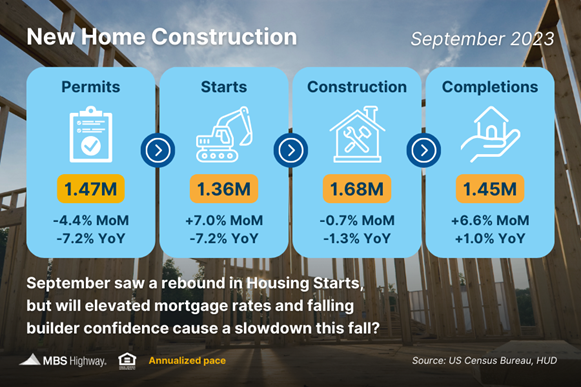

Housing Starts (which measure the start of construction on homes) rebounded in September after reaching two-year lows in August, up 7% for the month. While the bulk of the increase came in multi-family units, starts for single-family homes also rose 3.2%. Building Permits, which are indicative of future supply, did decline 4.4% from August while permits for single-family homes reached their highest level in a year.

What’s the bottom line? Alicia Huey, NAHB Chair, noted that the uptick in single-family construction “was somewhat unexpected” as elevated mortgage rates have dampened home builder confidence. She added that “starts are likely to weaken in the months ahead,” which would further impact already tight supply.

In fact, when we look at the pace of completed homes that will be coming to market (around 1.45 million homes annualized) and subtract roughly 100,000 homes that need to be replaced every year due to aging, we’re well below demand as measured by household formations that are trending at 2 million. Even looking at future supply (Building Permits at 1.47 million annualized), we’re still lower than where we need to be.

The bottom line is that more demand than supply will continue to be supportive of home values.

Home Builder Confidence “Hammered” by Elevated Rates

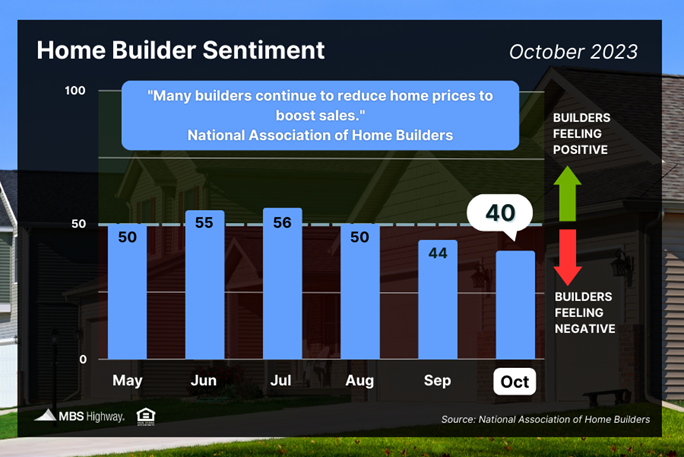

The National Association of Home Builders (NAHB) Housing Market Index fell four points to 40 in October, keeping builder sentiment below the key breakeven level of 50. This marks the third straight monthly decline, with confidence at the lowest level since January. All three components of the index moved lower, with current sales conditions dipping four points to 46, future sales expectations down five points to 44, and buyer traffic falling four points to 26.

What’s the bottom line? Rising mortgage rates was a key reason cited for declining confidence, as “builders have reported lower levels of buyer traffic” per NAHB Chair Alicia Huey. Higher rates have also impacted builder costs, further eroding sentiment. But there was a glimmer of good news for potential buyers – 32% of builders reported cutting prices, matching last month for the largest percentage since last December.

More Signs of a Fed Rate Hike Pause?

There has been a growing chorus of Fed members who are inclined to hold rates steady at their next meeting on November 1, given the progress made toward taming inflation and tightening conditions. This includes New York Fed President John Williams, Vice Chair Michael Barr, Fed Governors Phillip Jefferson and Christopher Waller, Atlanta Fed President Raphael Bostic, San Francisco Fed President Mary Daly, Dallas Fed President Lorie Logan and Philadelphia Fed President Patrick Harker.

Remember, the Fed has been hiking its benchmark Fed Funds Rate (which is the overnight borrowing rate for banks) to try to slow the economy and curb inflation.

Their latest hike in July was the eleventh since March of last year, pushing the Fed Funds Rate to the highest level in 22 years. The Fed did not hike at their September meeting, so they could continue to assess incoming inflation, labor sector and other economic data.

What’s the bottom line? Last week, Fed Chair Jerome Powell stressed that the Fed is “proceeding carefully” as they walk the line between doing too much and doing too little to get inflation back down to their 2% target. However, he made it clear that additional rate hikes could still be ahead if strong economic data undermines the progress made on inflation.

“WARNing” Ahead for Jobless Claims?

Initial Jobless Claims fell by 13,000 in the latest week, with 198,000 people filing for unemployment benefits for the first time. This is the second lowest level of the year and marks the first time since January that claims have fallen below 200,000, suggesting that employers are holding on to workers.

However, Continuing Claims increased 29,000, as 1.734 million people are still receiving benefits after filing their initial claim. This data has moved higher over the last few weeks, indicating that it’s becoming harder for people to find employment once they’re let go.

What’s the bottom line? While Initial Jobless Claims have been on a downward trend since hitting 250,000 at the start of August, a recent rise in announced layoffs via “WARN” notices could lead to a reversal higher in unemployment filings. The Worker Adjustment and Retraining Notification Act (WARN) is an important consumer protection that requires employers with 100 or more employees to provide at least 60 calendar days advance written notice of a plant closing and mass layoff affecting 50 or more employees at a single site of employment.

Family Hack of the Week

Fall is a perfect time to bake with apples. This Chunky Apple Cake from Taste of Home won’t disappoint.

Preheat oven to 350 degrees Fahrenheit. Lightly grease and flour a 9×13 inch pan.

In a large bowl, cream 1/2 cup butter (softened), 2 cups sugar and 1/2 teaspoon pure vanilla extract. Add 2 eggs, one at a time, and beat well. In a separate bowl, combine 2 cups all-purpose flour, 1 1/2 teaspoons cinnamon, 1 teaspoon ground nutmeg, 1/2 teaspoon salt and 1/2 teaspoon baking soda. Gradually add flour mixture to creamed mixture. Stir in 6 cups chopped and peeled apples until well combined.

Add batter to prepared baking tin and bake for 40 to 45 minutes or until top is lightly browned and springs back when touched. Cool for 30 minutes before serving.

What to Look for This Week

More housing data is ahead, with September’s New and Pending Home Sales releasing on Wednesday and Thursday, respectively. Also on Thursday, look for the latest Jobless Claims and the first reading for third quarter GDP. A crucial inflation reading will be delivered on Friday via the Fed’s favored measure, Personal Consumption Expenditures.

Technical Picture

Mortgage Bonds moved higher on Friday, which is a welcome sign, as they have been oversold and are due for a rebound. Support can be found at 98.5, while the next ceiling of resistance is all the way up at the 99.697 Fibonacci level, so there is quite a bit of room for improvement. The 10-year tested resistance at 5%, which held, and yields ended the week trading around 4.90%, with the next floor at 4.67%.