Week of October 23, 2023 in Review

Consumer inflation continued to inch lower in September, while signed contracts for new and existing homes were better than expected, showing resiliency in the housing market. Read on for last week’s headlines:

-Inflation Inching Lower

-Pending Home Sales Perk Up in September

-Big Rebound in New Home Sales

-Third Quarter GDP Better Than Expected

-Jobless Claims Suggest Slowdown in Hiring

Inflation Inching Lower

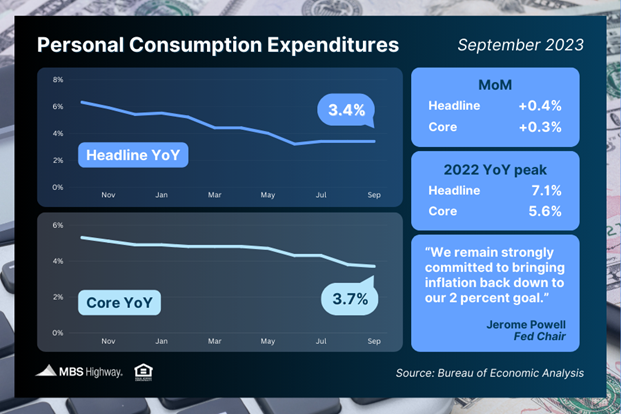

What’s the bottom line? September’s Personal Consumption Expenditures (PCE) showed that headline inflation increased by 0.4%, with the year-over-year reading holding steady at 3.4%. Core PCE, the Fed’s preferred method which strips out volatile food and energy prices, rose by 0.3% in September. The year-over-year reading fell from 3.8% to 3.7% – the lowest level in two years.

Inflation has made significant progress lower after peaking last year, with the headline reading at 3.4% (down from 7.1%) and the core reading at 3.7% (down from 5.6%). Plus, if we annualize the last six months’ worth of Core PCE readings (which the Fed did during their last meeting), Core PCE is even lower at 2.8%. While this is still above the Fed’s 2% target, it’s moving in the right direction.

Remember, the Fed has been hiking its benchmark Fed Funds Rate (which is the overnight borrowing rate for banks) to try to slow the economy and curb inflation. Their latest hike in July was the eleventh since March of last year, pushing the Fed Funds Rate to the highest level in 22 years. The Fed did not hike at their September meeting, so they could continue to assess incoming inflation, labor sector and other economic data.

Will the progress we’ve seen be enough for the Fed to pause rate hikes once again at their meeting this week? We’ll find out on Wednesday.

Pending Home Sales Perk Up in September

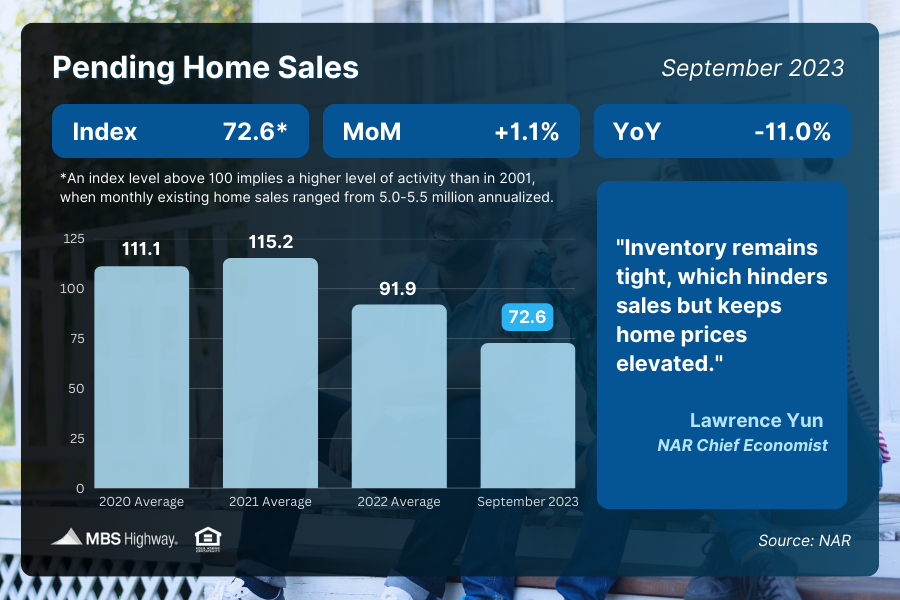

Pending Home Sales rose 1.1% from August to September, much stronger than the 2% decline that was expected, though sales were 11% below the level seen a year earlier. This data measures signed contracts on existing homes, making it a forward-looking indicator for closings as measured by Existing Home Sales.

What’s the bottom line? While September’s boost in signed contracts shows resiliency in the housing market, they remain at “historically low levels” per Lawrence Yun, chief economist for the National Association of REALTORS�. Elevated mortgage rates have certainly caused many buyers to press pause on the home search, but tight inventory remains a key challenge as well. Yun stressed that increased supply is crucial to “get the overall housing market moving.”

Big Rebound in New Home Sales

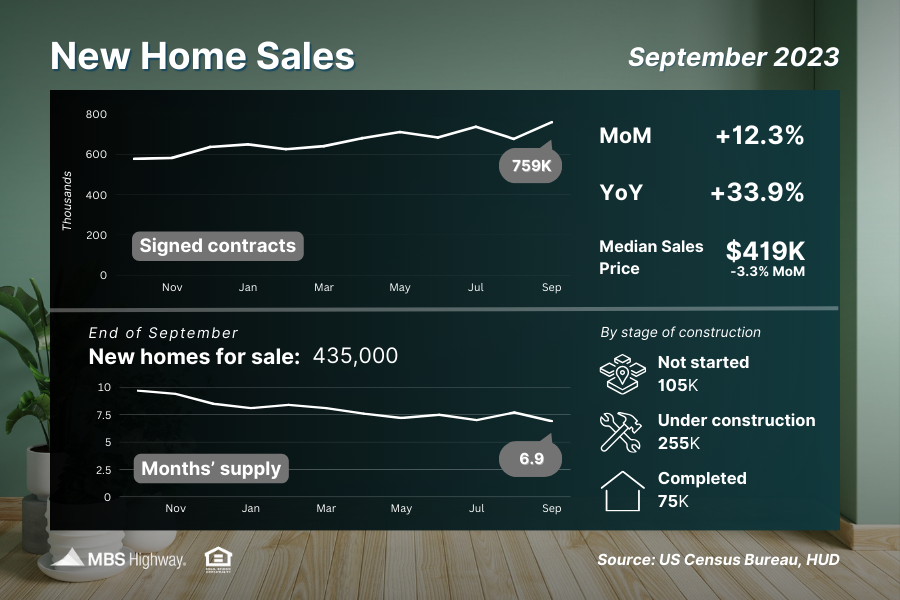

New Home Sales, which measure signed contracts on new homes, rose 12.3% from August to September to a 759,000-unit annualized pace. This was much stronger than estimates and the highest level in a year, with sales up nearly 34% since last September.

What’s the bottom line? The lack of existing homes for sale has caused many buyers to explore new construction options. Yet, more “available” supply is needed to meet demand, as only 75,000 of the 435,000 new homes available for sale at the end of September were completed. The rest were either under construction or not even started yet.

The tight supply of both existing and new homes will continue to be supportive of home prices. On that note, the median sales price for new homes was $418,800, which was down from $477,700 a year ago. While this may sound like home prices are declining, this figure is not the same as appreciation but represents the mid-price and can be skewed by the mix of sales among lower-priced and higher-priced homes.

Danushka Nanayakkara-Skillington, assistant vice president for forecasting and analysis for the National Association of Home Builders, explained, “To compensate for this high interest rate environment, more builders are building smaller homes, which has resulted in a decline in the median new home price.”

Third Quarter GDP Better Than Expected

The first reading of third quarter 2023 Gross Domestic Product (GDP) showed that the U.S. economy grew by 4.9%, higher than estimates, thanks in large part to the increase in consumer spending, inventories and government spending. Note that this data is subject to revision when the second and final readings are released on November 29 and December 21, respectively.

What’s the bottom line? GDP functions as a scorecard for the country’s economic health, so the strong reading in the third quarter seems promising. However, the increased spending seen over the summer months may not be sustainable, which could mean we’ll see a slowdown in GDP for the fourth quarter of this year.

Jobless Claims Suggest Slowdown in Hiring

Initial Jobless Claims rose by 10,000 in the latest week, with 210,000 people filing for unemployment benefits for the first time. Despite this weekly increase, the number of first-time filers remains near the lowest levels seen this year. The real story is Continuing Claims, which increased 63,000, showing that 1.79 million people are still receiving benefits after filing their initial claim.

What’s the bottom line? The low number of Initial Jobless Claims show that employers are trying to hold on to workers. Yet, Continuing Claims have now risen for six straight weeks. This suggests that it’s becoming harder for people to find employment once they are let go, indicating that hiring may be slowing down.

Family Hack of the Week

November is National Peanut Butter Lovers Month. These classic Peanut Butter Cookies courtesy of Allrecipes make for a delicious treat.

Preheat oven to 375 degrees Fahrenheit. Grease a baking sheet. In a large bowl, cream together 1 cup sugar and 1 stick butter (room temperature). Beat in 1 egg, then mix in 1 cup peanut butter and 1 teaspoon pure vanilla extract until smooth and creamy. Stir in 1/2 teaspoon salt, 1/2 teaspoon baking soda and 1 1/2 cups all-purpose flour until well combined.

Roll dough into 1-inch balls and then roll in sugar. Place on prepared baking sheet and flatten with a fork, making a crisscross pattern. Bake for 12 to 15 minutes until the edges are golden. Cool on a baking sheet briefly before moving to a wire rack to cool completely.

What to Look for This Week

Tuesday brings an update on home price appreciation for August via Case-Shiller and the Federal Housing Finance Agency.

Labor sector reports will also make headlines, starting Wednesday with job openings via the JOLTS report for September and ADP’s Employment Report (which measures private payrolls) for October. The latest Jobless Claims will be reported on Thursday, while Friday brings October’s Jobs Report from the Bureau of Labor Statistics, which includes Non-farm Payrolls and the Unemployment Rate.

But perhaps the biggest news will stem from the Fed’s two-day meeting which begins Tuesday, with their Monetary Policy Statement and press conference coming on Wednesday. Will the Fed once again pause hikes to the Fed Funds Rate?

Technical Picture

Mortgage Bonds broke above the ceiling at 99.316 last Friday. If they can stay above this level, the next ceiling is 99.697. However, if they move lower, we must remain on guard because the next floor is all the way down at 98.5. The 10-year ended last week trading in the middle of a range between resistance at 5% and support at 4.71%.