Ever really stopped to wonder where Mortgage Rates come from – I doubt it but in any case, it is interesting – does relate to the overall and our personal economy and it could be helpful to understand what you can do about it. A lot of people believe that mortgage lenders arbitrarily pick interest rates and throw them out in the world to see who will take them – they also believe there is some sort of flexibility and negotiation readily available. The reality is for most lenders, banks and other firms that make mortgage loans, mortgage interest rates are determined by daily market trading in what is called mortgage-backed securities or MBS.

Ultimately, each lender sets a profit margin and makes the determination from a business purpose what they must do to be profitable and support their mission and reason to be in business. And once they fix that margin, the pricing they offer goes up and down depending on the trading of mortgage-backed securities and rarely changes from there, until the lender changes their margin. The pricing an individual loan officer can offer is fixed based on the compensation plan each company has set with that loan officer. Once set it cannot change and is structured this way by regulation to prevent price manipulation. A loan officer or mortgage advisor cannot charge more or less if a transaction is more challenging – they cannot get paid more or less for choosing a type of product or specific interest rate. It has not always been this way, but Anti-Steering regulation put in place after the 2008 Financial Crisis eliminated variable compensation.

So, what is a MBS (mortgage-backed security)? It is a simply a financial instrument; much like a Bond or Treasury Note. Closed mortgages are packaged together by lenders and then sold in what is called the secondary market. You own them and I own them in our retirement accounts. Investment companies, banks and other countries buy them – even our own Federal Reserve buys them. They are a safe investment that offers a higher rate of return than many other safe fixed investment instruments.

How does it work? Looking at this chart, each red or green vertical bar are called Japanese candlesticks – each of those bars represents a day’s trading. A green bar would represent that the trading got better during that day, a red bar would represent that the trading got worse that day and therefore pricing got a little bit worse. You will see the arrow on the left at the peak of the market – mortgage pricing would have been best on this day. Pricing gets worse or better as a trend is established (note the arrows showing a down and uptrend). Green Days are good, Red days are bad.

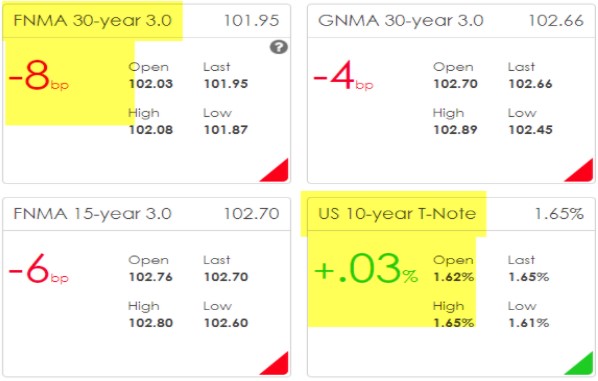

A lot people believe that the 10-year Treasury sets mortgage pricing, but that is not accurate, the news media consistently gets this wrong. There is some minor correlation but not every day; you will see here for example.

On this day, the trade shows that the mortgage-backed securities are down 8 basis points and the Treasury notes up 3 basis points, that is an 11-basis points difference. The point difference may not mean anything to you, but it could mean an eighth or a quarter in pricing incorrectly stated.

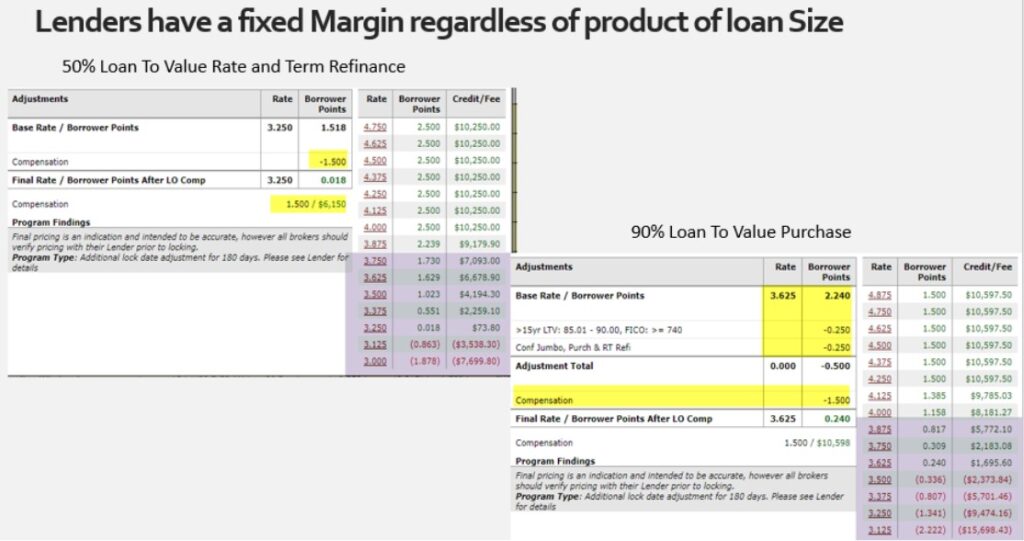

Ultimately, lenders have a fixed margin regardless of the loan size – in this example we have a 50% loan to value refinance. You will see the lenders compensation, in this case it is 1.5%, highlighted. All these pricing options are available. The borrower can pick any one of these prices and the lender compensation does not change.

The lenders compensation is fixed, it is not going to change if the borrower chooses 3.625% with a credit back of almost $7,000 – if they choose a 3.250%, they’re going to have to pay a fee of about $74. The advice of a good loan officer will help them determine what the best financial outcome is. The second example is a 10% Down Purchase – same lender compensation and the borrower has the choice of multiple rate and fee combinations.

The Loan Officers compensation never changes, it cannot change by law, but lenders pricing does change and that is because again of course there are differences in being competitive, company overhead and business practices – if a lenders wants to get more loans in or slow down their inflow they can choose to increase or decrease their margin when they sell into the MBS market – effectively adjusting the price that is offered to consumers on the front end by loan officers.

Here is a quick snapshot; a $1.2 million purchase with 20% down, there is about 8-10 different lenders here.

Union Bank Wholesale, CMG, Caliber or GMAC and Plaza – are big nationwide companies, but you will see that their pricing varies. It is the same 3.75% rate across the board here but different pricing: some with credits and some with Discount Points. Again, your loan may not fit at every lender, it may only fit at Plaza for example, in case that is the price you get.

Typically, in the marketplace a mortgage broker or loan officer will match you with the right program at the lowest margin lender, that can close in the time frame you want with the terms you want. That is because they have access to different lenders along with different pricing and products. Whereas, typically, retail banks and smaller mortgage bankers have access to just their product alone. At the end the day, due to access to multiple lenders, mortgage brokers typically have access to the widest choices of products and pricing.

Pricing does change throughout the day; it is just like trading stocks. It goes up and down throughout the day – and be aware that pricing is not typically committed until you are in escrow. The best advice I have to give you as to what you can do about this interesting trading in MBS and lender pricing is that you should find the lender you trust, who is committed to educating you. They have transparent pricing numbers, are clear with you about what they are earning and how the process works, and they are focused on your well-being and positive outcome.

Short Headline Version

Where do Mortgage Rates Come From?

- Lenders fix a Margin

- Trading in Mortgage Backed Securities changes pricing continually

- Loan Officers have a fixed compensation that does not change

YouTube Link