Week of September 4, 2023 in Review

- Is the Fed Planning to Pause Rate Hikes?

- New High in Home Price Appreciation

- Holiday Impact on Unemployment Filings

Is the Fed Planning to Pause Rate Hikes

There was a parade of Fed speakers last week and there were signs that the Fed may be ready to pause rate hikes at their upcoming meeting on September 20. Comments from voting members were particularly noteworthy, including New York President John Williams, who said he believes monetary policy is in “a good place” and “having the desired effect.” While he thinks the Fed needs to keep its options open based on incoming data, his tone suggested he favors pausing hikes this month.

Dallas Fed President Lorie Logan also said skipping a hike this month “could be appropriate,” though she noted more tightening may still be needed for inflation to reach their 2% target. Philadelphia Fed President Patrick Harker has also said that the Fed may be at a point to “hold rates steady.”

Remember, the Fed has been hiking its benchmark Fed Funds Rate (which is the overnight borrowing rate for banks) to try to slow the economy and curb inflation. Their latest hike in July was the eleventh since March of last year, pushing the Fed Funds Rate to the highest level in 22 years.

What’s the bottom line? The Fed has been looking for clear signs that the labor market is softening as they consider further rate hikes. While job growth has appeared strong in recent reports, a closer look at the Bureau of Labor Statistics data shows a clear downtrend in job growth.

Not only has monthly job growth slowed, but negative revisions are growing as well. Most recently, for example, job creations in June were revised from the originally reported 209,000 all the way down to 105,000 after two months of revisions. In addition, the unemployment rate has moved higher from the low of 3.4% in April to 3.8% last month.

Are these signs of weakness enough to convince the Fed to pause rate hikes? This week’s inflation data will also play a role in their decision, which will be announced after the Fed’s meeting concludes next Wednesday, September 20.

New High in Home Price Appreciation

Home prices rose 1.5% from June to July per Black Knight’s Home Price Index, which was a big acceleration from the 0.7% monthly increase reported for June and the third month in a row this index set a new all-time high. On an annual basis, prices were up 2.3%, with the pace of appreciation at 4.4% from the beginning of this year. This equates to a 7.5% annualized pace if gains continue at this rate. Ninety-nine out of 100 cities showed gains in Black Knight’s index.

What’s the bottom line? The latest rise in home prices reported by Black Knight mirrors the strong growth seen by Case-Shiller, CoreLogic, Zillow and the Federal Housing Finance Agency. These gains are a far cry from the housing crash that many media pundits had forecasted and show that opportunities exist right now to build wealth through homeownership and appreciation.

Holiday Impact on Unemployment Filings

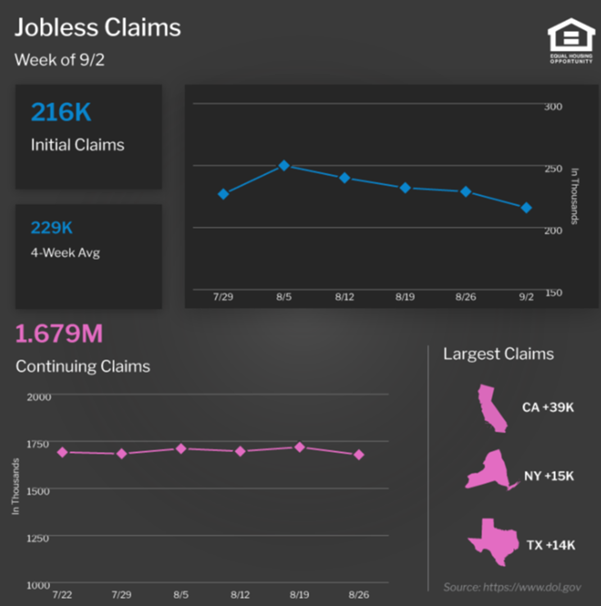

Initial Jobless Claims fell by 13,000 in the latest week, with 216,000 people filing for unemployment benefits for the first time. Continuing Claims also declined by 40,000, with 1.679 million people still receiving benefits after filing their initial claim. This latter number has been trending lower since topping 1.861 million in early April, reflecting a mix of people finding new jobs and benefits expiring.

What’s the bottom line? While the decline in Initial Claims appears to show a strong labor market, the measured week was the lead up to Labor Day weekend, which could have skewed this number as people often put off filing around holidays. Note that Continuing Claims lag a week, so they were unaffected by the holiday.

Also of note, there have been reports that large companies like Adidas, Adobe, IBM, and Salesforce are “quiet cutting” their employees. In other words, they are reassigning workers with lower pay and a lower title so they can trim costs. These reassignments have more than tripled over the past year and could partly explain why unemployment claims have remained low.

Family Hack of the Week

September is National Honey Month. This Simple Honey Cake courtesy of Taste of Home is perfect for savoring the flavor all month long.

Preheat oven to 350 degrees Fahrenheit. Grease a 9-inch round cake pan or spray with baking spray. In a large mixing bowl, beat together 1/2 cup unsalted butter, 1 cup honey, 1/2 cup plain Greek yogurt and 1 teaspoon pure vanilla extract. Add 2 large eggs one at a time, beating well after each one.

In a separate bowl, whisk together 2 cups all-purpose flour, 2 teaspoons baking powder and 1/2 teaspoon salt. Add the dry ingredients to the batter, stirring until just combined. Pour batter into prepared pan and bake for 35 to 40 minutes or until a toothpick inserted in the center comes out clean.

Serve warm, drizzled with extra honey. Garnish with mixed berries and crushed pistachios if desired.

What to Look for This Week

Crucial inflation reports are ahead, starting with August’s Consumer Price Index on Wednesday. Look for the Producer Price Index on Thursday, which will give us news on wholesale inflation.

Also of note, Tuesday brings the NFIB’s report on confidence among small business owners for last month. August’s Retail Sales and the latest Jobless Claims will be reported on Thursday. Investors will also be closely watching Tuesday’s 10-year Note and Wednesday’s 30-year Bond auctions for the level of demand.

Technical Picture

Mortgage Bonds ended last week battling their 25-day Moving Average. If Bonds can break above this level, the next ceiling is up at 98.60. The 10-year is trading in a range between a ceiling at 4.28% and a floor at the 25-day Moving Average.