Week of January 22, 2024 in Review

Inflation continues to move lower towards the Fed’s 2% target, while declining mortgage rates boosted signed contracts on new and existing homes in December. Here are the latest headlines:

Key Inflation Measure Below 3%

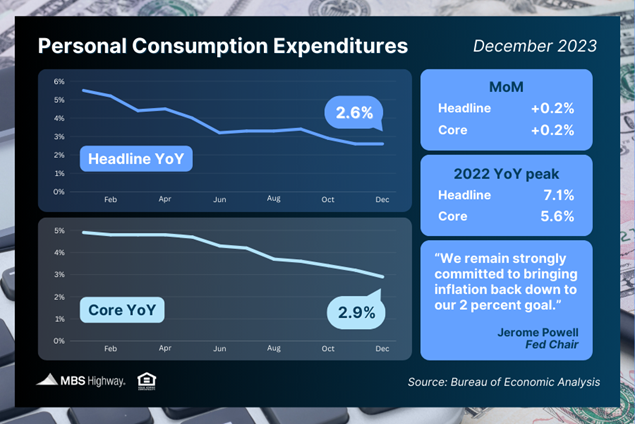

December’s Personal Consumption Expenditures (PCE) showed that headline inflation rose 0.2% for the month, with the year-over-year reading holding steady at 2.6%. Core PCE, the Fed’s preferred method which strips out volatile food and energy prices, also rose by 0.2% in December. The year-over-year reading fell from 3.2% to 2.9%, pushing this important metric below 3% for the first time in nearly three years!

What’s the bottom line? Inflation has made significant progress lower after peaking in 2022, with the headline reading at 2.6% (down from 7.1%) and the core reading at 2.9% (down from 5.6%). Plus, inflation is expected to decline even further this year, especially as some lagging components like falling shelter costs are better reflected in the reporting.

The Fed has been working hard to tame inflation, hiking its benchmark Fed Funds Rate (which is the overnight borrowing rate for banks) eleven times between March 2022 and July 2023. They did not hike at their September, November or December meetings, so they could continue to assess incoming inflation, labor sector and other economic data.

The Fed’s next meeting begins Tuesday and their Monetary Policy Statement and press conference on Wednesday could provide crucial hints regarding what’s ahead for rates this year.

New Home Sales End 2023 on High Note

New Home Sales, which measure signed contracts on new homes, rebounded in December, up 8% from November and beating forecasts as falling mortgage rates and the lack of existing homes for sale brought some buyers to the new construction market. Signed contracts were also 4.4% higher than they were in December 2022.

What’s the bottom line? Alicia Huey, Chair for the National Association of Home Builders, confirmed that “the solid new home sales rate in December was fueled by a lack of existing inventory in the resale market and declining interest rates.” She added, “The rise in sales also coincides with our latest builder surveys, which show a marked increase in future sales expectations because of falling mortgage rates.”

Any boost in builder confidence and construction is welcome news for inventory, as more “available” supply is still needed to meet buyer demand. Of the 453,000 new homes available for sale at the end of December, only 81,000 were completed, with the rest either under construction or not even started yet.

Pending Home Sales Surged in December

Pending Home Sales climbed 8.3% from November to December per the National Association of REALTORS® (NAR), coming in much higher than expected as the improvement in mortgage rates clearly sparked activity last month. Sales were also 1.3% higher than the level reported in December 2022.

Pending Home Sales measure signed contracts on existing homes, making them an important forward-looking indicator for closings as measured by Existing Home Sales.

What’s the bottom line? NAR’s Chief Economist, Lawrence Yun noted that, “Home sales are projected to rise significantly in each of the next two years as the market steadily returns to normal sales activity.” He stressed that “increased supply will be essential to satisfying all potential demand.”

Fourth Quarter GDP Better Than Expected

The first reading of fourth quarter 2023 Gross Domestic Product (GDP) showed that the U.S. economy grew by 3.3%. While this is a decline from 4.9% in the third quarter, it was much stronger than estimates and due in large part to easing inflation and a strong pace of consumer spending.

What’s the bottom line? While this data is subject to revision when the second and final readings are released on February 28 and March 28, respectively, the stronger than expected first reading is promising given that GDP functions as a scorecard for the country’s economic health.

In addition, GDP for all of 2023 grew at a 2.5% annualized pace, higher than the 1.9% growth seen in 2022 and well above forecasts at the start of last year that had called for little to no growth.

Jobless Claims Move Higher

Initial Jobless Claims rose by 25,000 in the latest week, which was higher than expected, as 214,000 people filed for unemployment benefits for the first time. Continuing Claims also came in above forecasts, up 27,000 as 1.833 million people are still receiving benefits after filing their initial claim.

What’s the bottom line? Initial Jobless Claims can be volatile from week to week, yet they remain relatively low on a historical basis, suggesting that employers are trying to hold on to workers. And while Continuing Claims have fallen from highs hit late last year, they are still elevated, especially when compared to September’s low of 1.658 million filers. This suggests it’s become harder for people to find employment once they are let go.

Family Hack of the Week

February is National Chocolate Lovers Month! This Chocolate Mousse courtesy of the Food Network is a delicious treat for the chocolate lover in all of us.

Place 5 1/4 ounces of coarsely chopped bittersweet chocolate in a double broiler on a low simmer. Stir chocolate until melted, turn off heat and let stand. Add 14 ounces of cold heavy cream to a bowl and beat over ice until soft peaks form. Set aside and hold at room temperature.

With a mixer, whip 3 large egg whites to soft peaks. Gradually add 1 ounce sugar and whip until firm. Add chocolate to a large bowl and use a whisk to fold in egg whites. When egg whites are nearly fully incorporated, fold in the whipped cream.

Cover mousse and refrigerate for 1 hour until set. Serve in goblets topped with more whipped cream and shaved chocolate.

What to Look for This Week

The Fed’s first meeting of 2024 begins Tuesday, with their Monetary Policy Statement and press conference coming on Wednesday. More housing news is also on deck Tuesday with an update on home price appreciation for November via Case-Shiller and the Federal Housing Finance Agency.

Labor sector data is also plentiful, starting with the JOLTS (job openings) report for December on Tuesday and January’s ADP Employment Report (which measures private payrolls) on Wednesday. The latest Jobless Claims will be reported on Thursday while Friday brings January’s Jobs Report from the Bureau of Labor Statistics, which includes Non-farm Payrolls and the Unemployment Rate.

Technical Picture

Mortgage Bonds ended last week in a tight range with support at 101 and the 25-day Moving Average nearby as the closest ceiling of resistance. The 10-year ended Friday battling resistance at its 50-day Moving Average. Yields are getting squeezed between the 50-day and a floor at the 200-day Moving Average.