FICO scores impact many areas of our lives but especially Mortgages – the impact is HUGE over time! Years ago in the mortgage business, you got rewarded for having a good credit score. As your credit score went up, lenders gave you incentives and better pricing. That has completely flip-flopped since the financial crisis in 2008. Now, lenders expect you to have perfect credit and if you do not have perfect credit, you get dinged for that. A lower FICO score affects you significantly in these areas:

- Interest rates

- Costs of getting a mortgage

- Down payment qualifying. There are minimum credit scores for down payments, especially on larger loans. Certain products require minimum credit scores. And for qualifying – the worse the credit score, the higher the interest rate, the higher your payment and your ability to qualify is impacted.

FICO scores offered on many banking services and through phone apps and Credit Karma type services, are not the same as FICO scores used by mortgage lenders. There are several scoring models. Each one is a proprietary model that Fair Issac’s Company (FICO) developed and sells to different industries. Often the consumer credit scores are significantly higher than the ones you would see on a mortgage FICO because of course, there is a greater risk with a mortgage.

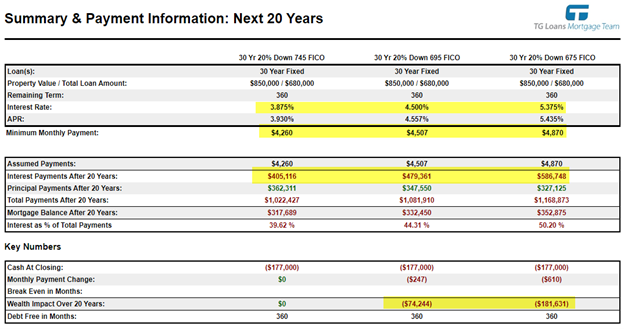

Let us review an example to see the impact. In this example, we will review an $850,000 purchase with a 20% down payment, with three different credit scores. 745, which is pretty good. Once you get above 745, the impact is pretty much the same. There are a few instances where that is not true in the super jumbo and jumbo marketplace but for most mortgages any FICO score above 740 – would get you the best terms. And we will see what happens with a 695 and 675 FICO score.

Quick purchase. $850,000 purchase, $680,000 mortgage with a rate at 3.875%, gives you a payment of $4,260. Over a 20-year period, you pay $405,000 in interest which would represent about 39% of your overall payments. With the 695 credit score, now you get a 4.50% rate, and your payment is $4,507. Your interest costs over 20 years are $479,000 and now it is 44% of your payment. That same mortgage costs you $74,000 over that 20-year period. Now at a 675 FICO you get a 5.375% rate with a payment of $4,870, and $586,000 in interest paid and it is cost you $181,000 more than if you had that better credit score. It is not that difficult to get from 675 to 745. It just takes some diligence and a little bit of time.

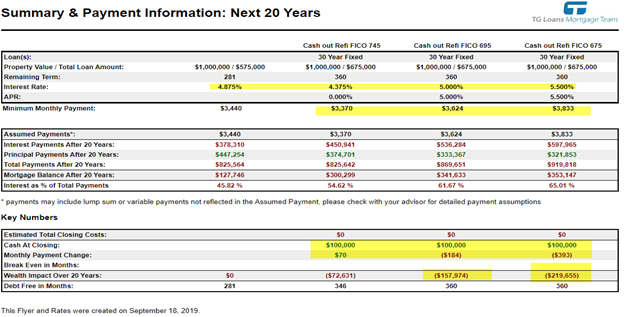

Impact on a refinance. Let’s say someone has a $1,000,000 home. They have an existing mortgage of $575,000 and a rate of 4.875%. The objective might be to pull cash out, lower the interest rate, and get lower payments. With a 745 FICO score, 4.375% rate, your payment is $3,370. You are saving $70 a month on the payment, and you got $100,000 cash out – goal accomplished! That $100,000 could be invested. It could go back into the home improvements, or into paying for college.

But 695 credit score, now the rate is higher than where they are today. The payment goes up by $184. They do get the $100,000 and maybe that’s worthwhile depending on the plan with the cash – but it might be better to improve the credit score. With a 675 credit score, now the rate is all the way up to 5.50% and the payment is going up by $393 a month, $3,833 and it is costing quite a bit of money over time.

Key Points:

- It’s more critical than ever to focus on a good credit score.

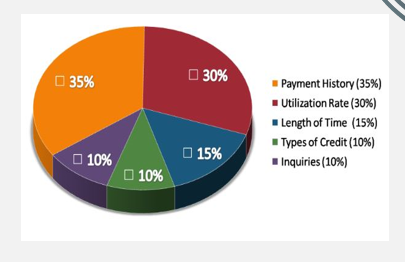

- The most important element of this is being less than 30% usage, meaning that, on your credit cards, if you have got a $10,000 credit card, you want your balance to always be under $3,000, and of course, zero is better (See Pie Chart Below for what makes up your FICO credit score)

- Do not close old accounts. Credit improvement takes time – you want older accounts with open credit and no balances. Lenders don’t let you work on credit scores during transactions- you need 90 days between credit reports.

- If you ever want to work on this yourself, there is a free consumer site annualcreditreport.com. You get a free credit report from each one of the bureaus one time a year. It is straight from the bureau so that’s a great way of doing it and you should be checking at least once a year on each bureau.

Short Title

FICO scores affect many critical areas of our lives – including mortgages. Learn why and how to get your score as high as possible.