Week of November 22, 2021 in Review

The Fed’s favorite measure of inflation, Personal Consumption Expenditures (PCE), showed that consumer inflation rose 0.6% in October. Year over year, the index increased from 4.4% to 5%, which is the hottest reading in over 30 years! Core PCE, which strips out volatile food and energy prices and is the Fed’s real focus, was up 0.4% in October while the year over year reading increased from 3.7% to 4.1%.

Rising inflation is always critical to monitor because it can have a big impact on Mortgage Bonds and home loan rates, which are tied to them. Don’t miss our analysis below about what may be ahead for inflation.

On a related note, with oil prices at seven-year highs, President Biden announced that the Department of Energy will release 50 million barrels of oil from the Strategic Petroleum Reserve in an attempt to push oil prices lower. This was a coordinated effort with other countries, and we should see the impact on oil prices over the coming months.

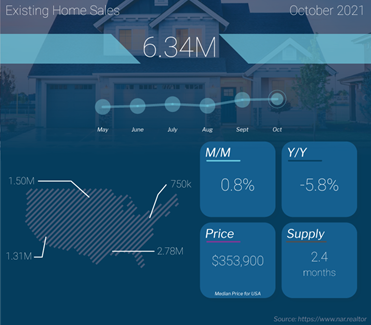

In housing news, sales of existing homes ticked up nearly 1% from September to October to an annual pace of 6.34 million units. This follows a large jump in sales in September. However, on an annual basis, sales are nearly 6% lower than they were in October of last year. The lack of homes for sale continues to remain a challenge around the country, as inventory declined almost 1% to 1.25 million homes for sale at the end of October.

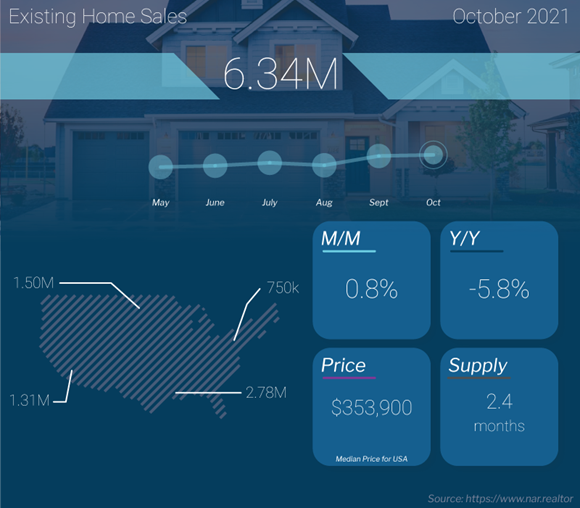

New Home Sales, which measure signed contracts on new homes, were also up 0.4% in October at a 745,000 annualized pace. However, this headline number does not tell the whole story, as explained below.

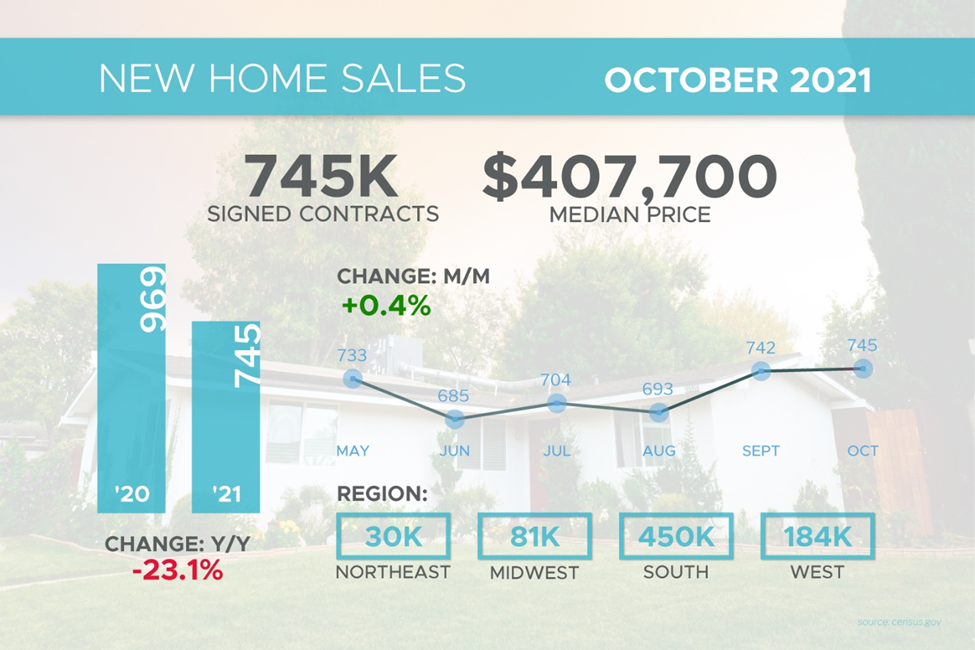

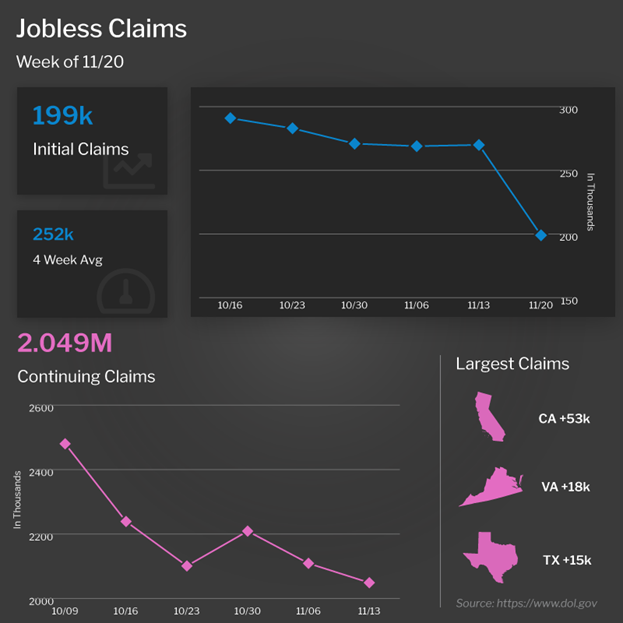

Initial Jobless Claims also made headlines, with the number of people filing for unemployment benefits for the first time falling by 71,000 to 199,000 in the latest week. Not only is this a pandemic-era low, it’s also the lowest level in 50 years! There are now 2.4 million people in total receiving benefits, which is down 752,000 from the previous week.

Also of note, the second reading of Gross Domestic Product (GDP) for the third quarter showed a slight revision higher from 2% to 2.1%, though this is still pretty anemic considering all of the stimulus.

Lastly, President Biden has confirmed that Jerome Powell will be re-nominated as Chair of the Federal Reserve for another term.

Annual Inflation Hits a 30-Year High

The Fed’s favorite measure of inflation, Personal Consumption Expenditures, showed that headline inflation rose 0.6% in October. Year over year, the index increased from 4.4% to 5%, which is the hottest reading in over 30 years.

Core PCE, which strips out volatile food and energy prices and is the Fed’s real focus, was up 0.4% in October. The year over year reading increased from 3.7% to 4.1%.

Remember that the year over year figures are on a 12-month rolling basis. This means that in last week’s report, the October 2020 reading of 0% for Core PCE was replaced with the 0.4% that was just reported for October 2021. This is why the year over year figure jumped significantly.

When we look ahead to the next report, which will be released on December 23 with data for November, we will be replacing another reading of 0% for Core PCE from November 2020. This means we may continue to see the PCE climb sharply.

Why is this important?

Remember, inflation is the arch enemy of fixed investments like Mortgage Bonds because it erodes the buying power of a Bond’s fixed rate of return. If inflation is rising, investors demand a rate of return to combat the faster pace of erosion due to inflation, causing interest rates to rise. This is why keeping an eye on inflation remains critical.

It’s also worth noting that the PCE is a poor measure of inflation because it has a low weighting towards housing and out of pocket medical expenses, both of which are very important to consumers. Real inflation is likely higher than what is reflected in this latest report.

Also of note, private sector wages are up 11% year over year, which speaks to the wage pressured inflation we are seeing from companies that are having to pay more to retain and hire workers.

Existing Home Sales Rise for Second Consecutive Month

Existing Home Sales, which measure closings on existing homes, inched up nearly 1% from September to October to an annual pace of 6.34 million units. This follows a large jump in sales in September. However, on an annual basis, sales are nearly 6% lower than they were in October of last year.

The lack of homes for sale continues to remain a challenge around the country, as inventory declined almost 1% to 1.25 million homes for sale at the end of October. This represents just a 2.4 months’ supply of homes at the current sales pace. Inventory is also 12% lower when compared to October of last year.

The median home price was reported at $353,900, which is up 13.1% year over year. Remember that the median home price is not the same as appreciation. It simply means half the homes sold were above that price and half were below it. Home sales under $250,000 fell 24% year over year, while sales of homes above $750,000 rose about 30%, which caused the median home price to rise.

First-time home buyers have accounted for 29% of sales, which is up from 28% in September. Cash buyers increased to 24% from 23%, while investors purchased 17% of homes, which was up sharply from 13% in September.

Digging Into New Home Sales Data

New Home Sales, which measure signed contracts on new homes, were up 0.4% in October at a 745,000 annualized pace. However, this headline number does not tell the whole story.

Sales in September were revised lower from 800,000 to 742,000. When factoring in this revision, New Home Sales are really down 6.8% from the originally reported number in September. But there was a big surge in sales in September from August (where there were 693,000 homes sold at an annualized pace). So, even though sales in October were just modestly higher than they were in September, they were up 7.5% from August.

Year over year, sales were down 23.1% but from 2019 they are up 6%. The year over year comparisons to 2020 are tough because of the abnormalities in the market during the pandemic last year.

The median home price came in at $407,700. Again, this is not the same as appreciation. It simply means half the homes sold were above that price and half were below it.

Initial Jobless Claims Reach Lowest Level in 50 Years!

The number of people filing for unemployment benefits for the first time fell by 71,000 to 199,000 in the latest week. Not only is this a pandemic-era low, it’s also the lowest level since November 1969.

California (+53K), Virginia (+18K) and Texas (+15K) reported the largest number of claims.

Continuing Claims, which measure individuals who continue to receive benefits, also hit a pandemic-era low, falling 60,000 to 2.049 million.

There are now 2.4 million people in total receiving benefits, which is down 752,000 from the previous week and more reflective of numbers prior to the pandemic.

Family Hack of the Week

This Saturday, December 4 is National Cookie Day and this Sugar Cookie recipe from our friends at the Food Network is a perfectly delicious way to mark the occasion.

Position oven racks in the top and bottom thirds of the oven and preheat to 375 degrees Fahrenheit. Line 2 baking sheets with parchment paper.

In a small bowl, whisk together 2 1/2 cups all-purpose flour, 1/2 teaspoon baking powder and 1/2 teaspoon fine salt.

In a large bowl, beat 1 1/2 cups sugar and 2 sticks unsalted butter (room temperature) with an electric mixer on medium-high speed until light and fluffy (about 4 minutes). Add 1 teaspoon pure vanilla extract and 1 large egg and beat to incorporate. Add the flour mixture in 2 batches and beat on medium-low speed until incorporated.

Add some sugar to a small bowl, then scoop heaping tablespoonfuls of the batter, roll them into balls and coat in the sugar. Place the balls on the prepared baking sheets so they are around 2 inches apart. Note you should have additional batter for a second batch.

Bake until the bottoms and edges are just golden brown, approximately 12 to 14 minutes. Let the cookies cool for a few minutes on the baking sheets, then transfer them to a wire rack to cool completely. Repeat with the remaining batter once the cookie sheets have cooled.

Enjoy with coffee, tea, friends and family alike!

What to Look for This Week

This week kicks off with important housing news via October’s Pending Home Sales on Monday while Tuesday brings an update on home price appreciation for September when Case-Shiller’s Home Price Index and the Federal Housing Finance Agency’s House Price Index are reported.

Important manufacturing updates for November will also be reported, first on Tuesday with the Chicago PMI and then on Wednesday with the ISM Index.

Then the rest of the week will be centered on important labor sector news, beginning Wednesday when the ADP Employment Report will give us an update on private payrolls for November. Thursday brings the latest Initial Jobless Claims data. Then ending the week on Friday, the highly anticipated Bureau of Labor Statistics Jobs Report for November will be released, which includes Non-farm Payrolls and the Unemployment Rate.

Technical Picture

Mortgage Bonds rebounded sharply last Friday, breaking above the ceiling of resistance at 101.79 and moving higher to end the week just above their next ceiling at the 25-day Moving Average. The 10-year fell below floors of support at its 25-day and 50-day Moving Averages, ending the week testing the next floor at its 200-day Moving Average.