Sometimes we “Find” Money –There are only 3 things to do with “Found” money.

Found Money is money you were not really expecting but something happened and now you have it – maybe it was a raise at work or a new job. Maybe some debt was paid off and there is more cash flow, or you refinanced with us, cut payments, and now have more cash flow. Perhaps, it was an inheritance or a tax refund and now we are faced with a choice, what do we do with this money that we call “found” money. There are only three things you can do with it; Spend it, Repay debt with it, Save/Invest it. Each those has a profound impact on your finances over your life.

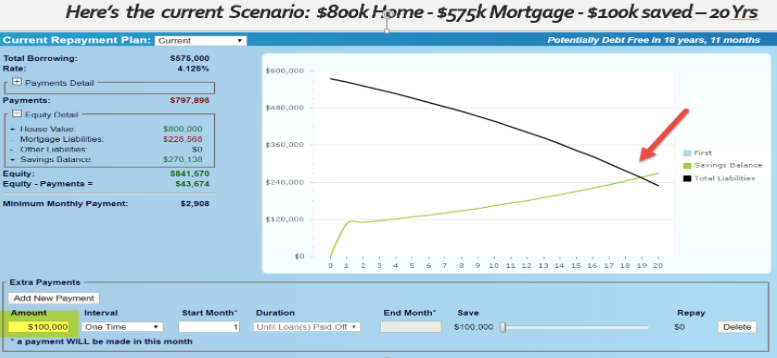

Scenario: an $800,000 home with a $585,000 mortgage, there is $100,000 saved in the bank and we’re going consider this over a 20-year period. The mortgage payments are $2908 a month – the $100,000 is invested and earning and over time will grow. Over 20 years it will grow to $270,000*. The crossover point (red arrow) is about 18 years and 11 months, where they could theoretically take all their cash and pay off the mortgage if they want to or continue to let the money grow over time.

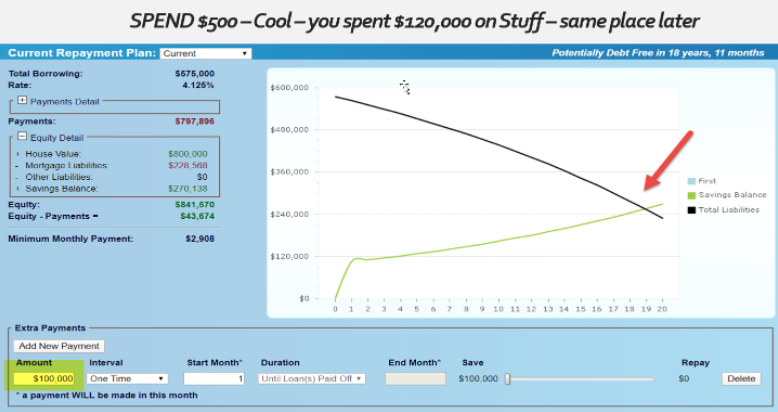

SPEND: What happens if you found five hundred bucks a month – that’d be cool. You could spend a $120,000 over twenty years (20 years of $500 a month). You would have $120,000 worth of stuff, which we know will not be worth $120,000, it will be worth much less. And you’re pretty much at the same place, only later; there was no impact on this house or your debt or anything else except you have more stuff!

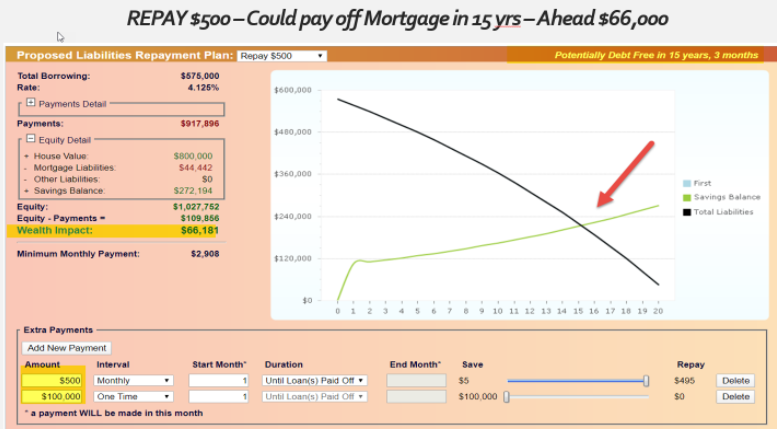

REPAY: What about using the money to repay debt. If we committed to repaying, we didn’t change our lifestyles, we just used the money for repayment – what happens now? We add the $500 to the $2908 mortgage payment and we still have our $100,000 that we had to begin with and that’s growing and represented by the green line.

The black line (Mortgage Debt) is going to reduce quicker because that’s being repaid more rapidly with the $500. They’re potentially debt free in 15 years and 3 months, the crossover point noted with the red arrow. This has an increased wealth impact of $66,000, so this decision was worth $66,000 over the twenty-year period.

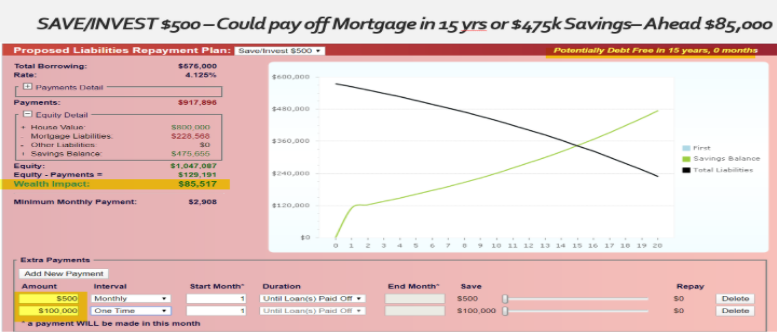

SAVE/INVEST: Here we add the $500 to the $100,000 we have invested and let that grow (the green line is now growing more rapidly. In 15 years, we have the choice to take our investment and pay off our mortgage or let it keep growing. Left alone for 20 years the savings/investment would be worth $475,000* – an $85,000 increase to our wealth.

We can see it is a significant decision on what to do with just $500 a month – and know that these “Found Money” decisions happen all the time!

RECAP: find money, got a job, new raise, paid off a debt, refinance and so forth, what are the three things that you can do with it? Spend it, repay debt with it, save, or invest it and each one of those has a profound impact on your life.

Please feel free to call us, talk to us and learn about these and other concepts because they are very powerful and we know that SMPL decisions you make regarding cash flow, can have a long-term, profound impact on your life!

- (Assumed 4% rate of return, we are not investment professionals, these are used to illustrate concepts and carry with them market risks)