There are 3 areas impacted:

- Initial investment (Down payment and Costs)

- Cash flow (payments)

- Net worth over time

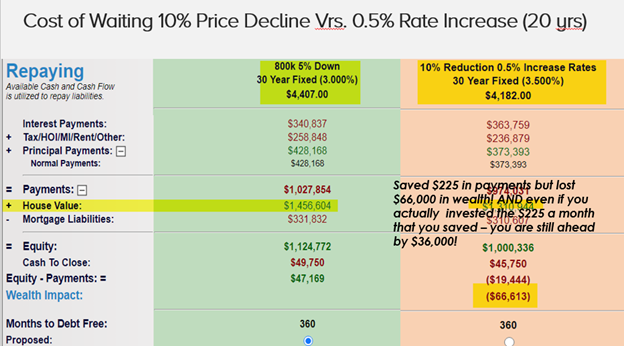

In this example, we look at an $800,000 purchase price. We get a normal 30-year fixed mortgage and look at comparing a 10% drop in price but a .50 % increase in rates. The payment on $800,000 buying today with 5% down is $4,407. This example is over 20 years, it would be more dramatic over 30, by the way. You will see total payments (PITI) of just over $1,000,000 and your home value is $1,456,000 (up from $800,000) assuming a 3% appreciation rate, which is about ½ what it has been in CA over 80 years.

Okay, on the waiting side, we wait two years. Rates go up half a percent to 3.50%. The payment now is $4,182. We saved about $225 a month but lost $66,000 in wealth. But theoretically, if you had saved your cash – the difference in payments – you would have that cash on the side. Very few people would do that – but let us assume you did – you are still ahead by $36,000. Granted not a huge sum, but you also gave up your own place for 2 years, paid rent for 2 years and did start building long term wealth.

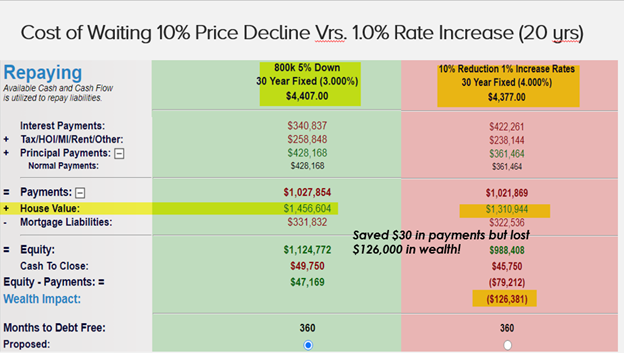

In the second example, we assume rates increase 1%. Same scenario, price (800k) and down payment of 5%. The home is now worth $1.456 million, but in this example, you only saved $30 month, but lost $126,000 in wealth over that same period.

In the end, this does not mean you should wait or not wait but the bottom line is, don’t make the assumption that you’re going to save a lot of money by waiting to see if prices drop. The reality is that interest rates have a lot more to do with your long-term wealth accumulation than your starting price on the home.

Check out additional Borrow Smart/Repay Smart Lessons on our YouTube Channel! See shortcut below:

Our Borrow Smart/Repay Smart Lessons on YouTube:

Is there a Cost to Waiting to Buy now or Should I Wait for a Price Drop?

There are 3 areas impacted:

- Initial investment (Down payment and Costs)

- Cash flow (payments)

- Net worth over time