A Planned Trade Down- combined with a HECM (Reverse Mortgage) is a financial planning strategy typically used by homeowners with significant equity in their homes. They are approaching retirement or preparing themselves to be in a stronger financial position. Usually, this type of planning is coordinated with financial advisors, estate planners, tax advisors and an overall retirement income plan.

The goals are:

- Increase retirement income

- Diversify and Protect assets

- Increase the estate and the net worth of the property.

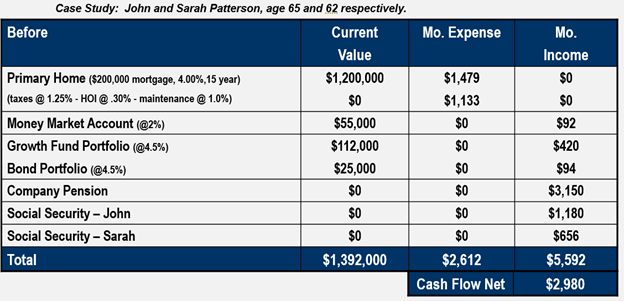

Meet John and Sarah Patterson. There ages are 65 and 62. They have a home worth about $1.2 million. The mortgage is $200,000 with a 15-year payment of $1,400. They have $200,000 in various accounts. Total asset value is $1.4 million. Their Income is from assets, company pension and Social Security. Total expenses are $2,600 a month and coming in is $5,600 a month for a net positive of $2,980 a month – to live their lives on. Please do not get stuck in all the numbers or minutia – the important thing is to understand the concept.

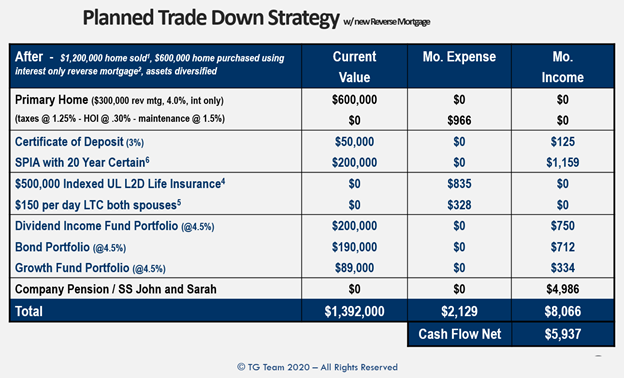

One option is a Planned Trade Down using a HECM (Reverse Mortgage). They sell their $1,200,000 million home and buy a $600,000 home. They borrow about $300,000 on a reverse mortgage, which gives them new liquidity of $700,000. That cash goes in a few different places, to create income, protection and liquidity. In this case, they also buy a single premium life insurance annuity, which throws off income and provides protection and meets legacy goals.

The overall concept is that you diversify assets that are sitting idly and moving those assets into more productive uses, one of which is generating more income. They also set up life insurance to protect their estate and provide a legacy for their kids – $500,000 when they both pass away. To protect themselves, they also set up long-term care insurance, which is a huge gap for many people

Assets are the same $1.4 million and expenses are now $2,129. They no longer have a mortgage payment due to the HECM (Reverse Mortgage). They can make payments on the mortgage, which can have significant benefits. Their total income is now $8,000 a month – after expenses a net of about $6,000 a month in income. Their income has almost doubled with all the same assets and probably a much simpler lifestyle. In Summary they:

- Freed up $700,000, ($500,000 was tax-free from the sale of their home)

- Increased income by $3,000

- Diversified funds and savings to be more protected

- Increased the estate value for their children with life insurance

- Protected themselves with long-term care insurance