Week of July 18, 2022 in Review

More to Existing Home Sales Data Than Meets the Eye

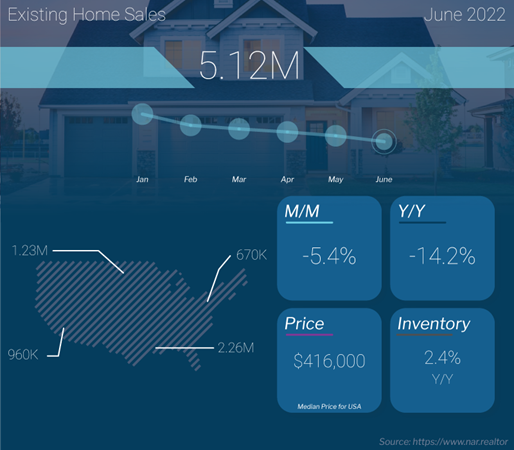

Existing Home Sales fell 5.4% from May to June, coming in at a 5.12 million unit annualized pace and worse than expectations of a 3.4% decline. On a year over year basis, sales were down 14%. This is a critical report for taking the pulse of the housing market, as it measures closings on existing homes, which represent around 90% of the market. June’s report likely reflects people shopping for homes in April and May, which included much of the rise in rates we’ve seen this year.

What’s the bottom line? While it’s true that buyer activity is slowing, multiple data points suggest that demand remains strong, which should continue to be supportive of home prices. For example, homes remained on the market for just 14 days on average in June, down from 16 days in May and the fewest days on the market since tracking this metric began in 2011. Plus, 88% of homes that sold in June were on the market for less than one month. Homes priced right are selling quickly.

In terms of inventory, there were 1.26 million homes available for sale at the end of June, which is nearly 10% higher than May’s inventory level. This equates to a 3 months’ supply of homes, up from 2.6 months in May. However, six months is considered a balanced market, so this data speaks to the ongoing imbalance of supply and demand, which also should continue to be supportive of home prices. Plus, some of the increase in inventory is due to seasonal norms this time of year and not lessening buyer demand, as the media may report. Every year, many parents list their homes for sale by late spring or early summer so their kids are settled before the new school year begins in the fall, which causes a normal inventory build over the summer months.

In addition, CoreLogic’s Single-family Rent Report showed that annual single-family rent growth remained at a record high in May, with rents up 13.9% when compared to May 2021. This report includes both new and renewal rents, which are rising around 8%. These increases in rental prices should continue to push people to see the opportunity in housing, which again will help homes continue to appreciate.

Lastly, Zillow released their July Home Values Index, showing that they think home values will increase 7.8% over the next 12 months. While this was a revision lower due to slower monthly appreciation numbers and a slower pace of sales, this level of appreciation is still extremely strong for wealth creation. Zillow believes we will see home price appreciation moderate to pre-pandemic levels, but that’s very different than a crash, it’s just a slower pace of appreciation.

Builders Cautious About Future Sales

The National Association of Home Builders (NAHB) Housing Market Index, which is a near real-time read on builder confidence, fell 12 points to 55 in July, coming in much worse than expectations of 65. Looking at the components of the index, current sales conditions fell 12 points to 64, future sales expectations were down 11 points to 50 and buyer traffic declined 11 points to 37.

What’s the bottom line? Any reading above 50 on this index, which runs from 0 to 100, signals expansion while readings below 50 signal contraction. While current sales conditions and future sales expectations remain above or at 50, the real concern is the weak buyer traffic reading.

NAHB’s chairman, Jerry Konter, said, “Production bottlenecks, rising home building costs and high inflation are causing many builders to halt construction because the cost of land, construction and financing exceeds the market value of the home.”

Construction Data Shows Continued Backlog

Supporting the comments from the NAHB, June saw a slowdown in home construction. Housing Starts, which measure the start of construction on homes, fell 2% from May to June, below the 1.4% gain that was expected. Starts for single-family homes, which are the most important because they are in such high demand among buyers, were also down 8.1%. Building Permits, which are a good forward-looking indicator for Housing Starts, fell 0.6% in June. Once again, single-family permits declined more significantly, dropping by 8%.

What’s the bottom line? Housing units authorized but not yet started were up almost 16% when compared to June of last year, which speaks to the backlog in building. In addition, completing homes remains one of the biggest challenges builders face. Overall housing completions were down 4.6% from May to June, while single-family units completed fell 4.1%, showing that the backlog continues to grow.

Initial Jobless Claims Top 250,000 for the First Time This Year

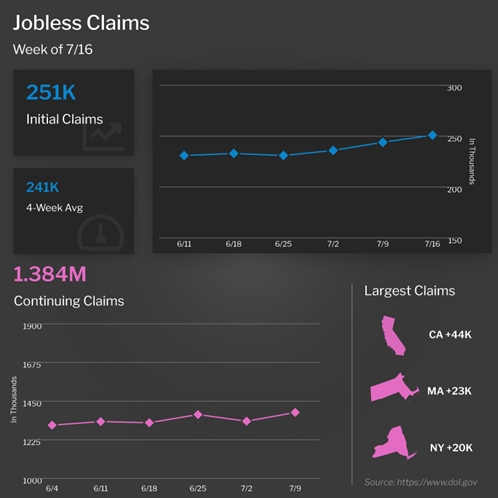

The number of people filing for unemployment benefits rose by 7,000 in the latest week, as 251,000 Initial Jobless Claims were reported. This is the first time since last November that this figure has been above 250,000. Continuing Claims, which measure people who continue to receive benefits after their initial claim is filed, rose by 51,000 to 1.384 million.

What’s the bottom line? Initial Jobless Claims have been steadily moving higher, with the 4-week average at its highest level since December. The trajectory higher is likely to continue, given the announcements of significant layoffs from several public companies, which means we will eventually see a higher unemployment rate. This report can be the “canary in the coal mine” to show that the job market is starting to soften.

Family Hack of the Week

Summer heat can be dangerous for people and pets alike. These important tips from the Humane Society can help keep our four-legged friends safe all season long.

On very hot days, limit walks to early morning or evening hours and walk dogs on grass if possible, as hot asphalt can burn their paws.

Keep a look out for signs of overheating in your pets, which include excessive panting, increased heart rate, drooling, weakness, glazed eyes, vomiting or even unconsciousness.

If you’re ever concerned your pet is suffering from heat exhaustion, follow these do’s and don’ts. If you’re away from home, move your pet into the shade so she can begin to cool off. If you’re at home, bring your pet inside, sit her in front of a fan and place a cool washcloth on her belly, ears, paws and neck. It’s important not to use cold water or a cold bath to help cool her off, as this could cause shock.

If you’re ever in doubt, call your vet and ask for further advice on what to do next.

What to Look for This Week

More housing news is ahead, beginning with Tuesday’s release of New Home Sales for June along with home price appreciation data for May from the Case-Shiller Home Price Index and the Federal Housing Finance Agency (FHFA) House Price Index. June’s Pending Home Sales data follows on Wednesday.

Thursday brings the first reading on GDP for the second quarter along with the latest Jobless Claims data, while crucial inflation numbers for June will be reported Friday via the Fed’s favored measure, Personal Consumption Expenditures.

But perhaps the biggest news will be the Fed’s two-day meeting beginning Tuesday, with the Monetary Policy Statement and press conference coming on Wednesday. The Fed is expected to again hike its benchmark Fed Funds Rate (this is the interest rate for overnight borrowing for banks and it is not the same as mortgage rates) to help cool inflation. Investors will be closely watching their actions and commentary.

Technical Picture

Mortgage Bonds broke into a new range at the end of last week, moving above their 50-day Moving Average and the Fibonacci retracement level. They back tested support throughout the on Friday but found a solid footing. Although there will likely be a lot of volatility this week, from a technical standpoint Mortgage Bonds have made some significant improvements.