Week of April 10, 2023 in Review

-Consumer Inflation Getting Better

-Wholesale Inflation Makes Huge Progress Lower

-Latest on Small Business Optimism…or Lack Thereof

-Unemployment Claims Trend Higher

-Fed Expects “Mild Recession” Later This Year

Consumer Inflation Getting Better

Consumer inflation rose 0.1% in March per the Consumer Price Index (CPI), with this headline reading coming in just below estimates. On an annual basis, CPI fell sharply from 6% in February to 5% last month.

Core CPI, which strips out volatile food and energy prices, increased 0.4% while the annual reading rose from 5.5% to 5.6%. This notch higher is partly due to a small replacement figure from last March, which was removed from the rolling 12-month calculation. Readings from April through June 2022 are higher comparisons, meaning annual Core CPI should decline in upcoming reports if readings this spring are lower than last year.

In addition, the shelter index increased 8.2% over the last year, accounting for over 60% of the total increase in all items less food and energy per the Bureau of Labor Statistics. However, shelter costs have been declining in more real-time data. For example, Apartment List’s latest Rent Report showed that year-over-year rent growth decelerated to 2.6% in March, the lowest level since April 2021. Once these moderating shelter costs are reflected in the CPI data, they should add additional downside pressure to inflation.

What’s the bottom line? While annual inflation remains elevated at 5%, it has declined sharply from the 9.1% peak seen last June. Lower inflation typically helps both Mortgage Bonds and mortgage rates improve, so these signs of easing inflation are welcome.

Wholesale Inflation Makes Huge Progress Lower

The Producer Price Index (PPI), which measures inflation on the wholesale level, decreased by 0.5% in March, coming in well below expectations of no change. On an annual basis, PPI saw a sharp decline from 4.9% to 2.7%. Core PPI, which also strips out volatile food and energy prices, fell by 0.1% with the year-over-year reading dropping from 4.4% to 3.4%.

What’s the bottom line? Annual wholesale inflation readings have made significant improvement as they continue to move lower in the right direction. At its peak last March, PPI was at 11.7% year-over-year and it is now at 2.7% – a decline of 9%! PPI is now at its lowest level since February 2021.

Latest on Small Business Optimism…or Lack Thereof

The National Federation of Independent Business (NFIB) Small Business Optimism Index weakened in March, falling to 90.1 and marking the fifteenth straight month the index has come in well below the 49-year average of 98. Among the key takeaways, 24% of small business owners reported that inflation remained their biggest problem, so the latest reports of cooling inflation are a positive development.

What’s the bottom line? Overall, small business owners are “cynical about future economic conditions,” per NFIB’s chief economist Bill Dunkelberg. He added, “Hiring plans fell to their lowest level since May 2020, but strong consumer spending has kept Main Street alive and supported strong labor demand.”

However, Retail Sales did fall 1% in March, after February brought a 0.2% decline from January’s stronger than expected sales. Business owners will be closely watching whether the pullback in spending continues this spring.

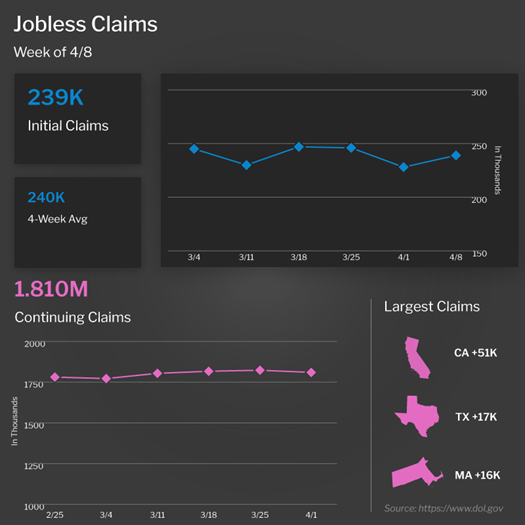

Unemployment Claims Trend Higher

The number of people filing for unemployment benefits for the first time rose by 11,000 in the latest week, with 239,000 Initial Jobless Claims reported. There were also 1.81 million Continuing Jobless Claims filed, which is a decline of 13,000 from the previous week. This represents people who continue to receive benefits after their initial claim is filed.

What’s the bottom line? The four-week average of Initial Jobless Claims, which smooths out some of the weekly fluctuation, has hovered around 240,000 in recent weeks, a high not seen since November 2021. And while Continuing Claims can also be volatile from week to week, the overall trend has been higher with an increase of more than 500,000 since the low reached last September. These numbers speak to the challenges people are having as they search for new employment.

Fed Expects “Mild Recession” Later This Year

The minutes from the Fed’s March meeting showed they believe there will be “a mild recession starting later this year, with a recovery over the subsequent two years.” The Fed also said they thought the recent banking crisis will result in a pullback in bank lending, which would have its own tightening effect on the economy.

On that note, several members considered forgoing a rate hike in March because of the banking turmoil but ultimately judged inflation to be too significant. Some members even noted they would have considered a 50 basis point hike to the Fed Funds Rate if there wasn’t any stress in the banking sector.

What’s the bottom line? The Fed has hiked the Fed Funds Rate nine times since March of last year, bringing it to a range of 4.75% to 5%. The Fed Funds Rate is the interest rate for overnight borrowing for banks and it is not the same as mortgage rates. When the Fed hikes the Fed Funds Rate, they are trying to slow the economy and curb inflation, which continues to ease per the latest CPI and PPI reports as noted above.

The Fed minutes also showed that they expect the Fed Funds Rate to reach a peak in May, which sounds like potentially one more 25 basis point hike at their May 2-3 meeting. The problem is that the Fed continues to look at lagging data instead of seeing the progress already made, even though the economy is showing signs of cracks and inflation is coming down.

Family Hack of the Week

Sunday, April 23 is National Picnic Day and this Orzo Pasta Salad courtesy of Country Living makes for an ideal culinary choice.

Bring a pot of salted water to a boil. Cook 2 cups orzo per package directions until al dente. Drain and spread on a baking sheet. Drizzle with 1 tablespoon olive oil and stir to coat. Cool completely in the refrigerator.

Whisk together 1/4 cup lemon juice, 2 tablespoons red wine vinegar and 5 tablespoons olive oil. Add orzo, 1 red bell pepper (sliced), 1 bunch chopped kale, 1 shallot (thinly sliced), 3 ounces grated Parmesan and 4 ounces crumbled Feta. Season with salt and pepper and toss to combine. Chill for 30 minutes and up to 2 days.

What to Look for This Week

Housing reports will be front and center, starting with builder confidence for this month from the NAHB on Monday. March’s Housing Starts and Building Permits will be reported on Tuesday while Existing Home Sales data follows on Thursday.

April’s manufacturing data for the New York and Philadelphia regions will be released on Monday and Thursday, respectively. The latest Jobless Claims will also be reported as usual on Thursday.

Technical Picture

Mortgage Bonds failed to remain above a triple floor of support formed by the 25-day Moving Average, 100-day Moving Average and 100.758 Fibonacci level. They ended last week with the aforementioned floors acting as a ceiling and the 50-day Moving Average acting as support. The 10-year moved sharply higher and ended last week battling its 200-day Moving Average.