Week of March 20, 2023 in Review

- Fed Hikes Rates Another 25 Basis Points

- Existing Home Sales Strong Despite Media Reports

- Signed Contracts on New Homes Rise for Third Consecutive Month

- Jobless Claims Reflect Tight Labor Market

- Decline in Demand for Big-Ticket Items

Fed Hikes Rates Another 25 Basis Points

The Fed hiked its benchmark Fed Funds Rate by 25 basis points at its meeting last Wednesday, marking the ninth hike since last March and bringing it to a range of 4.75% to 5%. The Fed Funds Rate is the interest rate for overnight borrowing for banks and it is not the same as mortgage rates. When the Fed hikes the Fed Funds Rate, they are trying to slow the economy and curb inflation.

What’s the bottom line? In the press conference following the meeting, Fed Chair Jerome Powell was grilled regarding the recent turmoil in the regional banking sector. He stressed that the Fed “took powerful actions with Treasury and the FDIC, which demonstrate that all depositors’ savings are safe and that the banking system is safe.” Powell noted that “deposit flows in the banking system have stabilized over the last week” and he criticized Silicon Valley Bank’s management, saying that the bank “failed badly” and exposed their customers to “significant liquidity risk and interest rate risk.”

Powell also said the committee considered a pause in rate hikes following the banking crisis but ultimately decided with a “very strong consensus” to proceed with hiking. Powell noted the Fed felt it was critical to sustain the public’s confidence that they can restore price stability, and they wanted to take action in furtherance of this goal.

Powell acknowledged that inflation has moderated since the middle of last year, but he cautioned that “the process of getting inflation back down to 2 percent has a long way to go and is likely to be bumpy.”

Existing Home Sales Strong Despite Media Reports

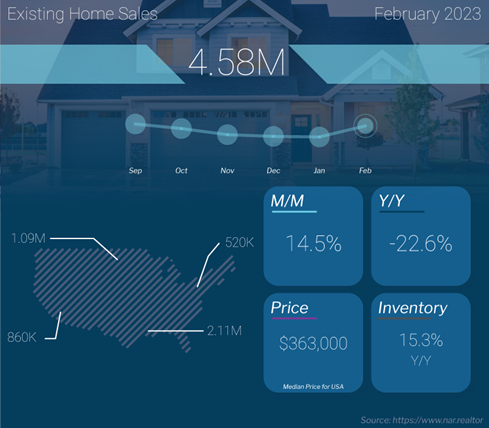

Existing Home Sales rose 14.5% from January to February to a 4.58 million unit annualized pace, per the National Association of Realtors (NAR), coming in much stronger than estimates and ending twelve consecutive months of declines. Sales were 22.6% lower than they were in February of last year, though this is less than the nearly 37% annual decline seen in January.

This report measures closings on existing homes, which represent around 90% of the market, making it a critical gauge for taking the pulse of the housing sector.

What’s the bottom line? February’s data showed signs of strength in the housing market, despite media headlines to the contrary. For example, while there was a 0.2% decline in the median home price to $363,000 from a year earlier, this is not the same as a decline in home prices as some reports implied.

The median home price simply means half the homes sold were above that price and half were below it, and this figure can be skewed by the mix of sales among lower-priced and higher-priced homes. Real appreciation data per the latest Case-Shiller Home Price Index showed that home prices were 5.8% higher than a year earlier.

In addition, there were 980,000 homes available for sale at the end of February, up from 850,000 a year earlier. However, this inventory increase is from a record low level and overall, supply is still much lower than in a balanced market.

Homes stayed on the market on average for 34 days, while 57% of homes sold in February were on the market for less than a month, which also speaks to continued demand for homes. NAR’s Chief Economist Lawrence Yun noted that, “Inventory levels are still at historic lows. Consequently, multiple offers are returning on a good number of properties.”

Signed Contracts on New Homes Rise for Third Consecutive Month

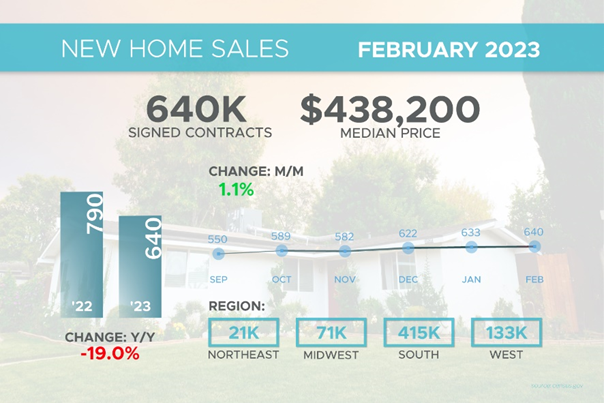

New Home Sales, which measure signed contracts on new homes, rose 1.1% in February to a 640,000-unit annualized pace. This was much stronger than estimates of a 3% decline and marks the third straight month that sales moved higher. However, downside revisions were made to January’s sales figure and sales remain 19% lower than they were in February of last year.

The median sales price rose from $426,500 in January to $438,200 in February. Again, this figure is not the same as appreciation but represents the mid-price and can be skewed by the mix of sales among lower-priced and higher-priced homes.

What’s the bottom line? There were 436,000 new homes for sale at the end of February, which equates to an 8.2 months’ supply at the current sales rate. However, only 72,000 were actually completed. The rest were either under construction or not even started, with the latter category spiking from January. This reflects a growing backlog among builders, as the number of completed homes equates to just 1.4 months’ supply, which is well below a balanced market.

Alicia Huey, Chair for the National Association of Home Builders, noted that builders report “strong pent-up demand” with many buyers “turning more to the new home market due to a shortage of existing inventory.”

Jobless Claims Reflect Tight Labor Market

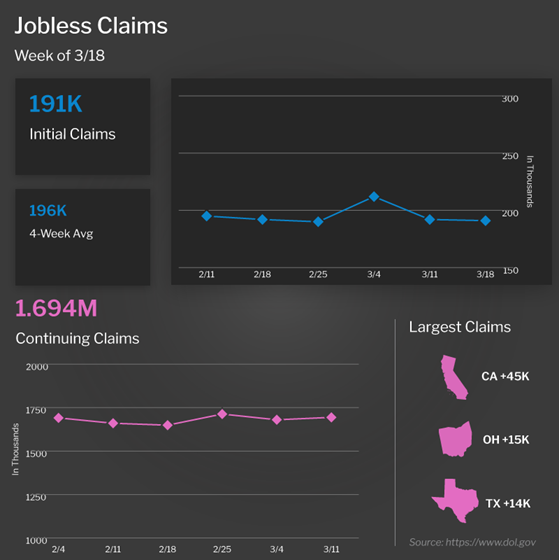

Initial Jobless Claims were flat in the latest week, as the number of first-time filers declined by 1,000 to 191,000. The number of people continuing to receive unemployment benefits after their initial claim is filed rose 14,000 to 1.694 million, which is one of the highest readings over the last year.

What’s the bottom line? The relatively low number of Initial Jobless Claims suggests that the labor market remains tight and companies are trying to retain workers. However, the high number of Continuing Claims also suggests it’s harder for people who are let go to find new employment. While these filings can be volatile from week to week, the overall trend has been higher. Continuing Claims have now risen by nearly 350,000 since the low reached last September.

Decline in Demand for Big-Ticket Items

Durable Goods Orders fell 1% in February, coming in much worse than expectations, while January’s report was also revised to the downside. Durable goods are products that are meant to last more than three years, such as cars, appliances and computers. These bigger, non-frequent purchases are typically financed, which has become more expensive now given the Fed’s hikes to the Fed Funds Rate. This data shows that the Fed’s rate hikes designed to lessen demand, and thereby lower inflation, are working.

Family Hack of the Week

Celebrate the start of baseball season with this Cracker Jack recipe courtesy of Allrecipes.

Preheat oven to 250 degrees Fahrenheit. Pop 11 cups of popcorn and spread on the bottom of a deep roasting pan. Sprinkle 1 cup Spanish peanuts on top.

In a large saucepan, combine 1 1/4 cups dark brown sugar, 10 tablespoons unsalted butter (cubed), 1/4 cup dark corn syrup, and 1 teaspoon Kosher salt over medium-high heat. Whisk constantly until butter and sugar are melted and sauce is thick and caramelized, approximately 2 to 3 minutes.

Pour sauce over popcorn and peanuts; stir until well coated. Bake for 45 minutes, stirring occasionally, until caramel and popcorn are crisped. Remove from oven and turn popcorn out in a single layer on parchment paper to cool.

What to Look for This Week

More housing news is ahead, starting with Tuesday’s release of home price appreciation data for January from the Case-Shiller Home Price Index and the Federal Housing Finance Agency (FHFA) House Price Index. Pending Home Sales for February will be reported on Wednesday.

Look for the latest Jobless Claims data along with the final reading for fourth quarter 2022 GDP on Thursday. Friday brings February’s reading for the Fed’s favored inflation measure, Personal Consumption Expenditures.

Technical Picture

Mortgage Bonds are continuing to battle with their 200-day Moving Average after opening above it Friday morning. This is a critical level to watch, as a clear break higher means the next stop is at 101.67. The 10-year ended last week at around 3.37% though it did move as low as 3.29%.