Week of October 10, 2022 in Review

Consumer Inflation Remains Hot But Is Hope Ahead?

The Consumer Price Index (CPI), which measures inflation on the consumer level, showed that inflation increased by 0.4% in September, double the amount economists expected. On an annual basis, inflation declined from 8.3% to 8.2%, though this was also above estimates.

The real story here was Core CPI, which strips out volatile food and energy prices. It also came in higher than forecasted with a 0.6% rise. As a result, year over year Core CPI increased from 6.3% to a hotter than expected 6.6%.

The increase in prices last month was broad-based, with shelter, rent, food and medical care services costs all rising in September. While gasoline prices declined 4.9% in September, they are 18.2% higher than the same time last year.

What’s the bottom line? Besides causing higher prices, inflation is the arch enemy of fixed investments like Mortgage Bonds because it erodes the buying power of a Bond’s fixed rate of return. If inflation is rising, investors demand a rate of return to combat the faster pace of erosion due to inflation, causing interest rates to rise as we’ve seen this year.

However, when we look at how inflation is calculated, there is hope that it may start to move lower in the months ahead.

Inflation is calculated on a rolling 12-month basis, which means that the total of the past 12 monthly inflation readings will give us the year-over-year rate of inflation. For example, when the data for September 2022 was released last week, it replaced the data for September 2021 in the calculation of annual inflation. Going forward, the inflation readings that will be replaced are much higher, so if we see lower monthly readings this fall and next year, the annual rate of inflation would then move lower.

Producer Inflation Also Higher Than Expectations

The Producer Price Index (PPI), which measures inflation on the wholesale level, rose 0.4% in September, coming in hotter than expectations. On a year-over-year basis, PPI decreased from 8.7% to 8.5%. While this moderated, it was also higher than anticipated. Core PPI, which strips out food and energy prices, was in line with estimates with a 0.3% increase. The annual figure declined from 7.3% to 7.2%.

What’s the bottom line? We still have not seen a meaningful decline in producer inflation. This can lead to hotter consumer inflation levels as producers have two options: reduce margins or pass along higher costs to consumers.

In addition, 30% of small business owners reported that inflation was their single most important problem in operating their business in September, per the National Federation of Independent Business Small Business Optimism Index. However, compensation and wages did moderate while owners expecting higher selling prices fell to the lowest level since September 2021. Both of these developments could signal moderating inflation in the months to come.

Fed Minutes Convey Hawkish Tone

The minutes from the Fed’s September meeting were released last week and they showed that the Fed believes it needs to continue its tightening policy even as the labor market slows. The Fed acknowledged that inflation was declining more slowly than anticipated and “many participants emphasized that the cost of taking too little action to bring down inflation likely outweighed the cost of taking too much action.”

The hawkish tone to the minutes shows the Fed’s priority is taming inflation, even if it means economic growth, consumer spending and the labor market could be hindered.

Remember, the Fed has been under pressure since late last year to address soaring inflation, and in response they have hiked their benchmark Fed Funds Rate five times so far this year, including their latest aggressive 75 basis point hike at their meeting on September 21. The Fed Funds Rate is the interest rate for overnight borrowing for banks and it is not the same as mortgage rates. When the Fed hikes the Fed Funds Rate, they are trying to slow the economy and curb inflation.

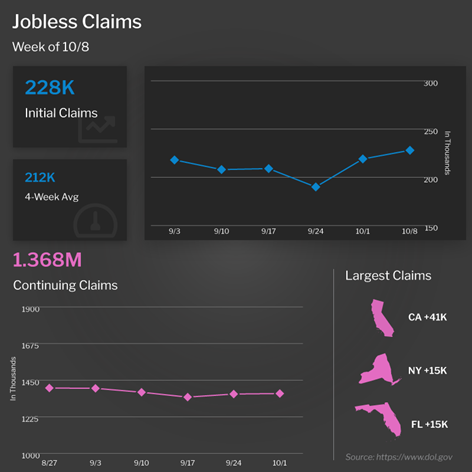

Initial Jobless Claims Rise for Second Consecutive Week

The number of people filing for unemployment benefits for the first time rose by 9,000 in the latest week, as 228,000 Initial Jobless Claims were reported. This followed a 29,000 increase in Initial Claims in the previous week. Continuing Claims, which measure people who continue to receive benefits after their initial claim is filed, were essentially unchanged, rising 3,000 to 1.368 million.

What’s the bottom line? Although the level of Initial Jobless Claims is still low, the increase in the last two weeks is significant and the trend in Initial Claims now appears to be higher. This report can be the “canary in the coal mine” to show that the job market is starting to soften, as an increase in the pace of firings is a precursor to a higher unemployment rate.

Family Hack of the Week

Halloween is nearly here! Enjoy an afternoon of carving pumpkins thanks to these handy tips from our friends at Good Housekeeping.

Start with a pumpkin that has a sturdy stem, no bruises and a flat bottom so it will stay in place once you start carving it.

Instead of cutting the lid at the top, cut it at the bottom. Not only can this help prevent the sides from caving in, but it will also be easier to place the pumpkin over candles or lights.

An ice cream scoop is a handy tool for removing pulp. Thin the area for the face to around 1 1/4-inches, so it will be easier to carve the eyes, nose and mouth.

Sketch your design on paper first, or download a template, and then trace your design onto the pumpkin to avoid any errant cuts. To keep your pumpkin fresh and moist, spread petroleum jelly on the edges.

What to Look for This Week

Crucial housing reports will be released beginning Tuesday with the National Association of Home Builders Housing Market Index, which will give us a near real-time read on builder confidence for this month. Housing Starts and Building Permits for September follow on Wednesday, while September’s Existing Home Sales will be reported on Thursday.

The latest Jobless Claims numbers remain important to monitor when they are released as usual on Thursday. Plus, October’s manufacturing data for the New York and Philadelphia regions will provide important updates on that sector when it is reported on Monday and Thursday, respectively.

Technical Picture

Mortgage Bonds ended last week trading in an extremely wide range between the floor at last Thursday’s low of 96.98 and overhead resistance at 99.54. The 10-year eclipsed the 4.0% level and ended last week trading at around 4.02%, meaning it has a bit room until reaching the next ceiling at 4.075%.