Week of December 27, 2021 in Review

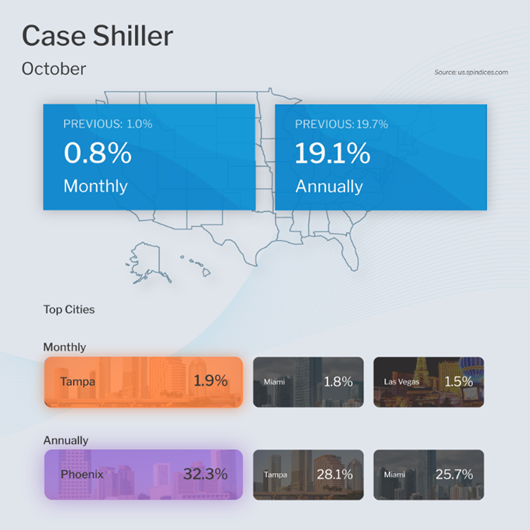

The high demand for homes around the country continues to help prices appreciate. The Case-Shiller Home Price Index showed that home prices rose 0.8% in October and 19.1% year over year. This annual reading was slightly lower than the 19.7% rise reported for September.

The Federal Housing Finance Agency (FHFA), which measures home price appreciation on single-family homes with conforming loan amounts, also reported that home prices rose 1.1% in October and 17.4% when compared to October 2020. The annual reading again was just below 17.7% from the previous report.

While the year over year appreciation figures are declining, this does not mean home prices are moving lower. Don’t miss our important expectation below.

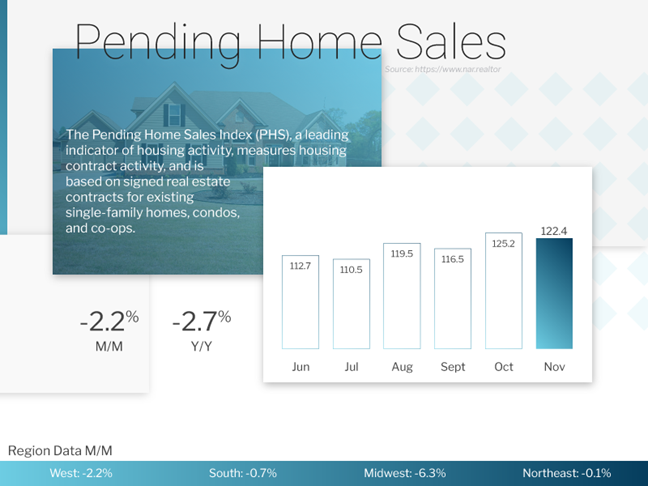

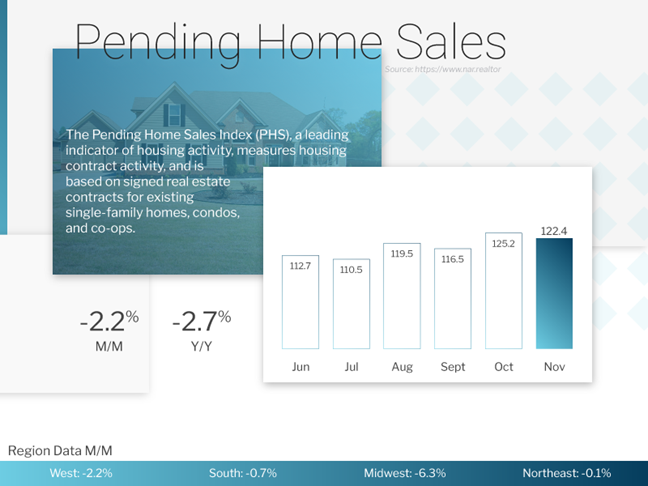

Pending Home Sales, which measures signed contracts on existing homes, fell 2.2% in November. This was short of the 0.5% expected increase. Sales are now down 2.7% year over year but are still quite strong when considering the lack of inventory and tough comparisons to last year due to the pandemic.

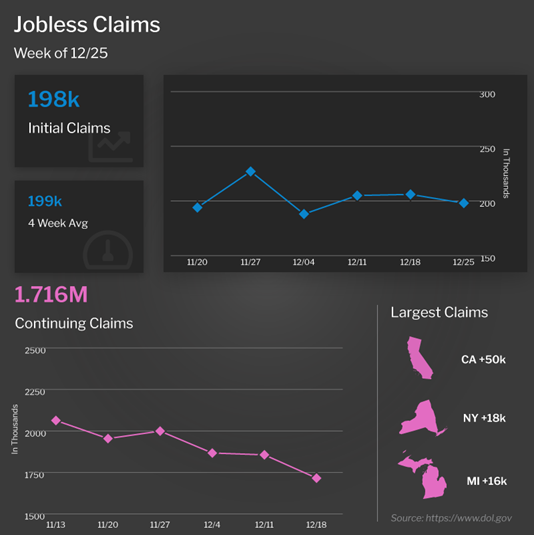

There was good news from the labor sector, as Jobless Claims continue to reflect pre-pandemic levels. The number of people filing for unemployment benefits for the first time fell by 8,000 in the latest week, as Initial Jobless Claims were reported at 198,000, which is near a 52-year low. Continuing Claims, which measures individuals who continue to receive benefits, decreased 140,000 to 1.716 million, once again reaching a pandemic-era low.

There are now 2.177 million people in total receiving benefits, which is a healthy number and in stark contrast to the 20 million plus seen last year.

And of note, investors were closely watching two auctions for the level of demand. Tuesday’s 5-Year Treasury Note auction was met with above average demand. The bid to cover of 2.41 was higher than the one-year average of 2.37. Direct and indirect bidders took 80% of the auction compared to 76% in the previous 12. However, Wednesday’s 7-Year Note auction was met with below average demand. The bid to cover of 2.21 was lower than the 1-year average of 2.29. Direct and indirect bidders took 78.8% of the auction compared to 78.1% in the previous 12.

What’s Really Going on With Home Price Appreciation?

The Case-Shiller Home Price Index, which is considered the “gold standard” for appreciation, showed home prices rose 0.8% in October and 19.1% year over year. This annual reading was slightly lower than the 19.7% rise reported for September.

So, why are the year over year appreciation figures declining? Does this mean home prices are moving lower?

The pace of appreciation month over month is decelerating, but we are still seeing home price gains. For example, in October 2020 home prices rose 1.51% while in October 2021 they rose 0.8%. Because the data for October 2021 shows a slower pace of appreciation then what was reported for October 2020, the year over year figure declined. But home prices are still rising.

The top three performing cities were Phoenix (+32%), Tampa (+28%) and Miami (+26%). Even the three worst-performing cities, including Chicago, Minneapolis, and Washington, saw 11.5% to 12% gains.

The Federal Housing Finance Agency (FHFA) released their House Price Index, which measures home price appreciation on single-family homes with conforming loan amounts. While you can have a million-dollar home with a conforming loan amount, the report most likely represents lower-priced homes, where supply has been tight and demand strong.

Home prices rose 1.1% in October and were up 17.4% year over year. This is down from the 17.7% year over year reading reported for September.

Pending Home Sales Decline in November

Pending Home Sales, which measures signed contracts on existing homes, fell 2.2% in November, which was short of the 0.5% expected increase. Sales are now down 2.7% year over year but are still quite strong when considering the lack of inventory and tough comparisons to last year due to the pandemic.

Lawrence Yun, chief economist for the National Association of Realtors, said, “There was less pending home sales action this time around, which I would ascribe to low housing supply, but also to buyers being hesitant about home prices.” He added, “While I expect neither a price reduction, nor another year of record-pace price gains, the market will see more inventory in 2022 and that will help some consumers with affordability.”

Yun also noted that housing demand remains high, and that homes placed on the market for sale go from “listed status” to “under contract” in approximately 18 days.

Initial Jobless Claims Near 52-Year Low

The number of people filing for unemployment benefits for the first time fell by 8,000 in the latest week, as Initial Jobless Claims were reported at 198,000. Remember that since this reading reflects the pace of firings and people filing for benefits, the lower the number the better.

Continuing Claims, which measures individuals who continue to receive benefits, decreased 140,000 to 1.716 million, once again reaching a pandemic-era low.

There are now 2.177 million people in total receiving benefits, which is a healthy number and in stark contrast to the 20 million plus seen last year. It also reflects that employers are having a hard time finding new workers and are reducing their pace of firings.

Family Hack of the Week

January is National Soup Month. And this recipe for Classic Chicken Noodle Soup from our friends at Food & Wine is a perfect way to kick off the year.

In a large stockpot, add one 3-pound chicken, 3 1/2 quarts of water, 2 carrots (chopped), 2 celery stalks (chopped), 1 onion (quartered), 1 clove garlic (smashed), 1 teaspoon whole black peppercorns, 1 large bay leaf, 6 parsley springs, and 2 thyme springs. Bring to a boil then cover partially, reduce heat to low and simmer for 30 minutes.

Transfer the chicken to a plate. Discard the skin, then pull the meat off the bones. Cut into 1/2-inch pieces and refrigerate.

Return the bones to the pot and simmer for about 1 hour. Strain the broth into a bowl and rinse out the pot. Return the broth to the pot and boil until reduced to 8 cups, approximately 30 minutes. Season with Kosher salt to taste.

Add 2 sliced carrots and 2 sliced celery stalks to the broth, cover and simmer until just tender (approximately 12 minutes).