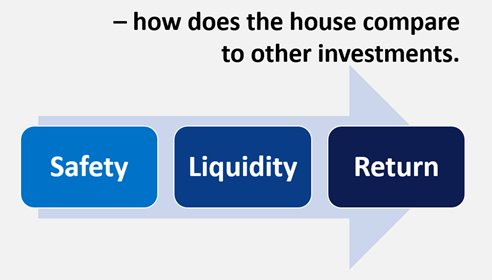

All investments are analyzed with three components – and the key Question is “How does my house compare to traditional investments?”

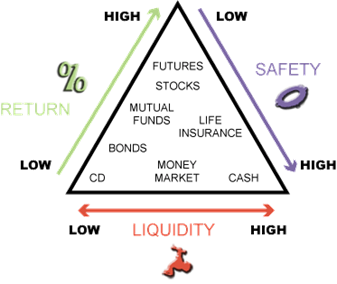

When we have money in savings or cash, we understand where that money is, how to get to it, and it feels safe. When we invest money into the stock market, mutual funds, and those types of investments, we understand that we are taking more risk but expect our money to be tied up longer and earn a higher rate of return!

Home Equity

Now, our house wealth, and we are not talking purely about the house value going up or down, but rather the money we’ve earned and then put into the home – the down payment and principal payments on a mortgage. Home equity is the difference between the mortgage amount you owe and the value of the home – this is house wealth when you look at it from a balance sheet perspective. Since this is the largest asset for most families, we must ask the question – “Is that asset safe, is it liquid, and what is the rate of return on it?” It doesn’t really matter what you’re investing in, whether it’s soybeans, gold, real estate, oil, the stock market bonds, and so forth – safety, liquidity, and a rate of return are the components we care about!

So where does the house fit into this model?

Looking at this model, we see cash has high liquidity, is safe, but a very low rate of return. Mutual funds are somewhere in the middle, they are relatively liquid, takes a few days to get our money if we sell and the rate of return and safety is somewhere in the middle. And then futures and individual stocks tend to have higher rates of returns, but are unsafe, due to volatility and are not overly liquid.

So where does our house fit? Most people do not ever think about it.

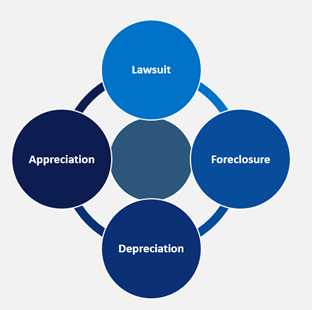

Safety is really the risk of loss of your money. There are four obvious threats to wealth in your home:

- Appreciation (causing increased expenses like tax and insurance)

- Depreciation – we understand that if my house value goes down; I have lost equity

- Foreclosure – due to a job loss or health issue.

- Lawsuit – when you get sued, your house becomes at risk of judgments and liens.

So that’s safety – the money inside your house. To be clear, we are not talking about the value of your house, it’s great if your house goes up from $500,000 or $600,000 – but we are focused on the money inside your house, the actual equity in the house itself.

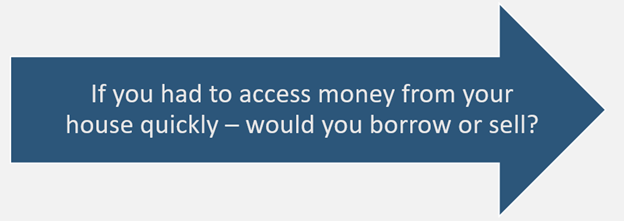

Key question:

When we compare real estate to other investments, and consider the safety of our largest asset, we realize that this asset value is mostly beyond our control. External influences like the overall economy, geopolitical issues, people tweeting, all those things affect the value of a home quickly and yet I have not control of those things! However, some things do have control over are:

- How much wealth we choose to put in our home

- The initial down payment you put on the home

- How you pay down the balance of your mortgage over time

A very simple strategy for protecting the wealth in your home is a HELOC (home equity line of credit). You can access the wealth in your home at any time by writing a check or drawing on that line of credit, giving you access to your equity and one way to protect the wealth in your home. For seniors over the age of 62, you can also consider a Home Equity Conversion Mortgage (HECM), also known as a reverse mortgage.

In terms of investing, before making any large principal reductions, make sure you understand safety, liquidity, and rate of return and discuss those decisions with the important advisors in your life.

Short Version

- Is your House an Asset – Is Your Equity Safe

- Compare Your home to other investments considering Safety – Liquidity – Rate of Return

- Threats to your Home Wealth include: Appreciation, Depreciation, Lawsuits, Foreclosure

Youtube Link

For all mortgage lending and HECM questions, reach us by phone, email, or schedule an in-person consultation HERE.