What is A Home Equity Line of Credit (or HELOC)?

It is not often that a financial product is so unique that it blows you away – but the “Bottomless Line of Credit” is exactly that! First, what is a line of credit? A line of credit is a revolving borrowing facility that can be used for any purpose. Once in place it can be accessed repeatedly for a variety of needs. A Home Equity Line of Credit (HELOC) is secured by the borrower home – it operates much like a credit card except you must qualify, have home equity, and secure it with your home. The “Bottomless Line of Credit” has some additional requirements to qualify but is not quite as stringent as the more traditional home equity line of credit.

Here are a few of the Unique features of the “Bottomless Line of Credit”:

- It can never be closed**

- The line grows each year regardless of the home value**

- Has very flexible payment options – from no payment to any amount

- You can change the payment options from month to month

- Can be used for any purpose (cash flow, home improvement, paying off debt, travel, gifts, health care, education etc.)

- Is insured by HUD

** You must live in and maintain the home and be current on taxes and insurance.

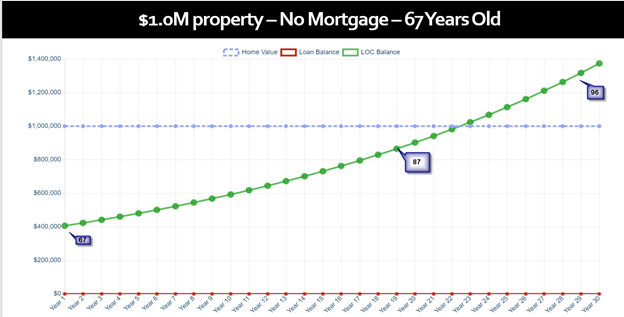

Scenario #1 – A million-dollar free and clear property, mortgage paid off and the homeowner is retired. They are 67 years old would qualify for approximately $400,000. From year one the line starts to grow, this green line represents the growth of the line and credit over time, so you will see it year 20 when they are 87, they are up to about $850,000 on their line of credit. This chart only goes out 30 years, but the line would continue to grow for life. Having access to several hundred thousand dollars, for any purpose later in life could be very powerful.

If the homeowner starting drawing on the line, they obviously would not have quite as much access and only the portion available continues to grow. The blue line represents the home value, we have left a static at a million dollars, obviously we know that real estate values change and are not static – they can go up or down – and remember with this product the line grows regardless of market value – the growth is tied to the underlying interest rate.

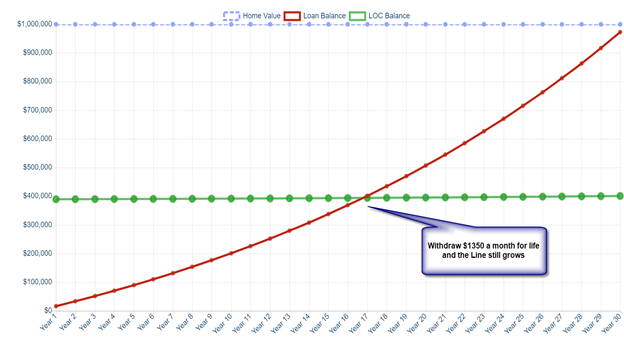

Scenario #2 – The reason we call it the bottomless line of credit is because of what is demonstrated on this example. I did the calculation to determine how much the homeowner could draw and still have the line of credit grow – in this case it is $1,350. The red line represents the debt growing over time, the green line represents the line of credit and blue line is the home value. Again, we have left it static for the time being, so the $400,000 available is a bit hard to see, but it is growing little by little.

You could withdraw $1,350 a month for the rest of your life, the line of credit will still be available, will still being growing slightly, therefore we call this a “Bottomless Line of Credit”

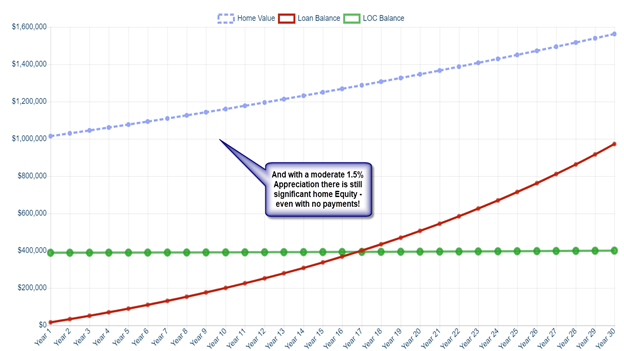

Scenario #3 – Let us put in some home appreciation (1.5%), still taking some money every month for life, and let us see how much home equity is left (if we make NO Payments).

The red line is the debt, the blue line is the home value and the gap between them is the home equity remaining in the home – in this example there is about $400,000 equity in the home AND if the homeowner made even a small payment it would be much larger.

So, this homeowner, took $1,350 in cash every month for 30 years, made no payments, had $400,000 in a line of credit for any purpose and still has $400,000 in home equity!

Nationwide, over long periods of time the home appreciation has been a bit over four percent, in California it has been higher.

This amazing tool that I call a “Bottomless Line of Credit” is more commonly known as the Home Equity Conversion Mortgage (Reverse Mortgage) – it is a very powerful planning and retirement tool. If used appropriately the HECM can help on homeowners use their home equity to fund their needs, offers flexibility and protection of other assets and against downturns in both the stock and real estate markets (we cover those in other lessons) safely and sustainably. The product is insured by HUD (Housing and Urban Development – essentially the Federal Government) and does require the homeowner to be 62 years old (some options available at 60 years old).

More and more homeowners and financial professionals are learning how the HECM can be incorporated into effective and sustainable retirement income planning.

To speak with one of our mortgage and retirement experts, contact us HERE.