Financial Freedom Planning

This subject is one of my favorite ones to discuss and share – Financial Freedom is something that just about everyone wants but the reality is that most people make very little effort and little time to think about this what this means in their lives and even fewer make concrete decisions to act!

Achieving financial freedom means different things to different people and there are a lot of questions to ponder things like:

- What does it really mean to you?

- Is there some secret?

- How do I get started?

- What happens when life gets in the way?

Let me start with #4 – Yes – life is going to get in the way, which is why you plan in the first place. Life is a journey; intentionally creating a lifestyle and life you want is why we are even talking about financial Freedom. By the way, Financial Freedom does not necessarily mean making and saving a lot of money – it is about discovering what you must have and plan your lifestyle around that – working and earning is a part of the plan and should be part of the lifestyle. The key to financial freedom is to find what it means to you; it is about lifestyle, making decisions relatively early in life or at whatever stage you are in life and deciding what is important to you right now and then managing the plan once created.

Step ONE: Build an emergency fund. This is for things like the car breaking, air conditioner repairs, unexpected expenses – stuff like that. Maybe you lost a job, there could be a health scare, etc. Ideally, 3 to 6 months of expenses in a liquid account is a great idea and where you start. First, build an emergency reserve so that when life does happen you don’t get thrown for a loop.

Step TWO – Pay off all your consumer debt. Consumer debt is all your debt other than a mortgage; if you already have a mortgage – pay the minimum you can on the mortgage and start working on everything else. Use a DEBT SNOWBALL – (Google it) – it is a simple process. Take all your individual debt, start with the smallest balance, and focus on that first – go to minimum payments on everything else and all your extra cash flow goes to the smallest balance. As soon as you’ve paid that debt off, you roll that payment down the next smallest debt and so on. The snowball gets bigger it goes downhill and each debt gets paid off. It does not matter if it takes a few months or a few years; the reality is that for you to get to Financial Freedom, you must get rid of credit cards, car loans, student loans and any consumer debt that you’ve built up over time.

Step THREE – You have your safety net; you have no other debt other than your mortgage and now you start building massive liquidity. A lot of people start to think about paying off their mortgage in this step, but the reality is you do not want to do that yet. You need to start building liquidity and you will understand why when we get to the bonus step! Here you build assets and move money into different buckets. You are investing in the stock market, bonds, real estate, and other assets! You are building liquidity, liquidity, liquidity; all extra money goes into building massive liquidity.

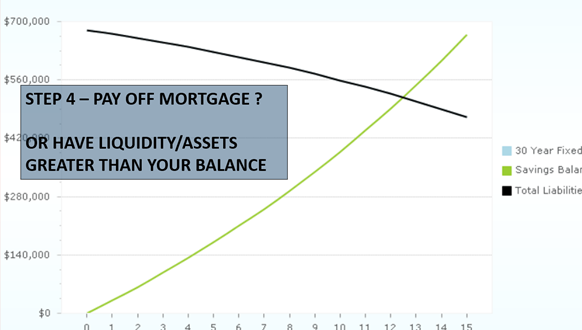

Step FOUR – Is to decide at some point to pay off your mortgage. Once you have enough liquidity and other assets – assets that exceed the balance of your mortgage ow you have choices and a financial decision to make.

In this example, if the mortgage balance is $550,000 and you have assets more than $550,000, technically you are mortgage free. To pay the mortgage off or not is a completely different financial decision and one that’s a lot more complex and takes careful planning. There are tax implications, retirement and education funding that may still be needed and other life and lifestyle goals that may be more important than paying off the mortgage. In any case you are Mortgage Free once you have assets more than your mortgage and can then choose to make a smart financial decision. A lot of people consider being mortgage and debt free a freedom point, but I think it is just the beginning of the final step. The goal here is to get enough liquidity and assets that are larger than your mortgage balance.

BONUS STEP – TRUE FREEDOM – Here what you are looking to do is to have enough assets generating passive income that exceeds your living expenses, straightforward right? Let’s say you have a $1,000,000 of assets. That $1,000,000 of assets throws off $100,000 of income per year – if your expenses are $90,000, you are financially free!

You no longer must work for money – Your money works for you. You can choose to do what you want to do with your lifestyle! The big key here creating a lifestyle that you truly enjoy and having passive income (asset) that exceeds your lifestyle expenses – it could involve living a smaller life than you imagine today, if you clearly know the lifestyle you want – Big or Small! Get income up, get expenses down and then start to build through these 4 Steps! It can be done in just a few years or some people may take an entire lifetime and never get there. What I can tell you is that if it important must follow the 4 Steps or you are likely to be in the second category that never gets to Financial Freedom.

Summary Post Info

The 4 Steps to Financial Freedom And 1 Bonus Step

Define what you want in a Lifestyle – ask the key questions:

- What does it really mean to you?

- Is there some secret?

- How do I get started?

- What happens when life gets in the way?

Follow the 4 Steps – Safety, Debt payoff, Liquidity and Mortgage Freedom

For an initial consultation contact our mortgage professionals HERE.